Jay Cohen, Director and Partner of Tilleke & Gibbins Cambodia, joined Ivan Cano, Content Manager of Realestate.com.kh, in sharing an introduction to Guaranteed Rental Returns.

Cambodia’s property market has seen massive growth and changes over the past decade. The influx of foreign investors made the landscape quite the competitive field and many new property investment opportunities throughout the Kingdom now come with Guaranteed Rental Returns (GRR).

What are Guaranteed Rental Returns?

In layman's terms, GRR is a future rental income that is guaranteed by the developer or management company to the property purchaser for a contracted period of time after the purchase agreement is signed.

For example:

|

Property Price |

$100,000 |

|

Guaranteed Rental Return (GRR) |

6% per year |

|

GRR Period |

2 years |

|

Expected Rental Return |

$12,000 over 2 years |

Sharon Liew, CEO of Huttons CPL, notes that Guaranteed Rental Returns is a reassurance scheme for new investors looking to try out a new, somewhat uncharted international market. Standard net returns being advertised in the condos and new developments market range from 4 percent to 9 percent, normally for a two to five year period.

Key considerations for Guaranteed Rental Returns

For potential investors faced with promises of Guaranteed Rental Returns, there are several points to consider before signing that dotted line.

Make sure the GRR is on a contractual document

Firstly, it is crucial to find out exactly what is underwriting the guarantee. If it is merely a paper promise it is potentially illusory - a marketing exercise that will collapse after the developments launch. However, if there is an actual contract in place, containing the potential for legal recourse should the income not be generated, the GRR presents some value.

“If there is a GRR scheme, the investor needs to make sure the GRR is set out in writing,” said Jay Cohen, Partner and Director of Tilleke & Gibbins Cambodia, highlighting the importance of having the Guaranteed Rental Return rate in writing. “There needs to be some sort of contractual document that sets out the rights to the GRR”

Guaranteed or Gross Rental Returns?

After setting the GRR out in writing, investors need to consider additional costs that may reduce an investor’s expected return; a common mistake that some novice investors make is to take the Guaranteed Rental Returns being offered as a reference point to calculate their returns.

Jay Cohen notes that investors need to be careful and understand what other costs may be imposed by the developer that may reduce their GRR. “Often in GRR schemes, there may be other costs that will reduce that amount. For example, management fees, sinking funds, utilities, furniture packages, and property taxes” he said.

For example:

|

Property Price |

$100,000 |

|

Guaranteed Rental Return (GRR) |

6% per year |

|

GRR Period |

2 years |

|

Expected Return |

$12,000 over 2 years |

|

Management fee per month |

$125 ($1,500 per year - $3,000 for 2 years) |

|

Utility bill per month |

$80 ($960 per year - $1,920 for 2 years) |

Expected return: $12,000 after 2 years

Costs over 2 years: $4,920 (Management fee + Utility bill)

Net Return Return: $7,080 over 2 years

Jay emphasizes the importance of having the GRR and the associated costs of owning the property to be on a contractual document and from there, understand what is their net return over the contract’s expressed period of time.

Sam Kiers, Director of Sales and Marketing at Elevated Realty, agrees: “This ultimately leads to investors seriously considering the time it takes for the investment to turn profitable.”

Desmond Yap, General Manager of Yong Yap Properties, believes that if it is the developer offering GRR, it is fair to assume they have done their calculations and have ensured they will not create a loss of profit for their company. “Thus, in effect,” says Yap, “the buyer is paying for their own Guaranteed Rental Returns.”

Know the going rate of similar properties

Jay Cohen notes that developers often look at surrounding properties of a similar tier along with calculating their desired ROI to come up with a GRR offer. Jay additionally impresses on investors that it is not uncommon for developers to inflate the rental guarantee figures to create a good impression on buyers considering the longer-term benefits of their investment. The opposite is true as well that a developer can undercut GRRs if they are confident they can rent/lease the property out for a much higher price.

For investors, another consideration about any GRR promise should be whether the rental income figure appears realistic and achievable in the current market, keeping in mind where the property is located. If it is clearly unrealistic, the investor should foresee a dramatic reduction in returns on their unit once the guaranteed rental period ends.

Sharon Liew explains that “In general, the projected GRR is usually lower than the market rental rate by about 20 percent, to protect the developer from any losses - this means, that anything higher than 20 percent (per year) is likely too good to be true.”

What happens after the GRR period ends?

“After a GRR period ends, the investor takes over the property and they have an obligation to lease it out themselves,” said Jay Cohen. Depending on the developer, they may offer their services to lease an investor’s property post-GRR for a nominal fee/arrangement. Jay Cohen emphasizes that this should be spelled out in a contractual document to avoid ambiguity or the requirement of additional services resulting in more fees.

Do a background check on the developer

It is advisable that the buyer must consider whether the developer or their property management company in fact has the ability and resources to manage the property properly and sustain rental tenants for the property over the guaranteed period.

Liew confirms that “The developer’s credibility and presence in Cambodia are extremely important, as most GRR only kicks off after the development is complete. This makes upfront rebate on Guaranteed Rental Returns a more attractive option.”

Look for an experienced property management operation, with past success in the local market.

“Be sure to check the validity of the GRR agreement and the quality of the management team," says Desmond Yap, “and, if possible, see how the management company is arranging their finances.”

Force Majeure, enforcement, and dispute resolution of GRRs

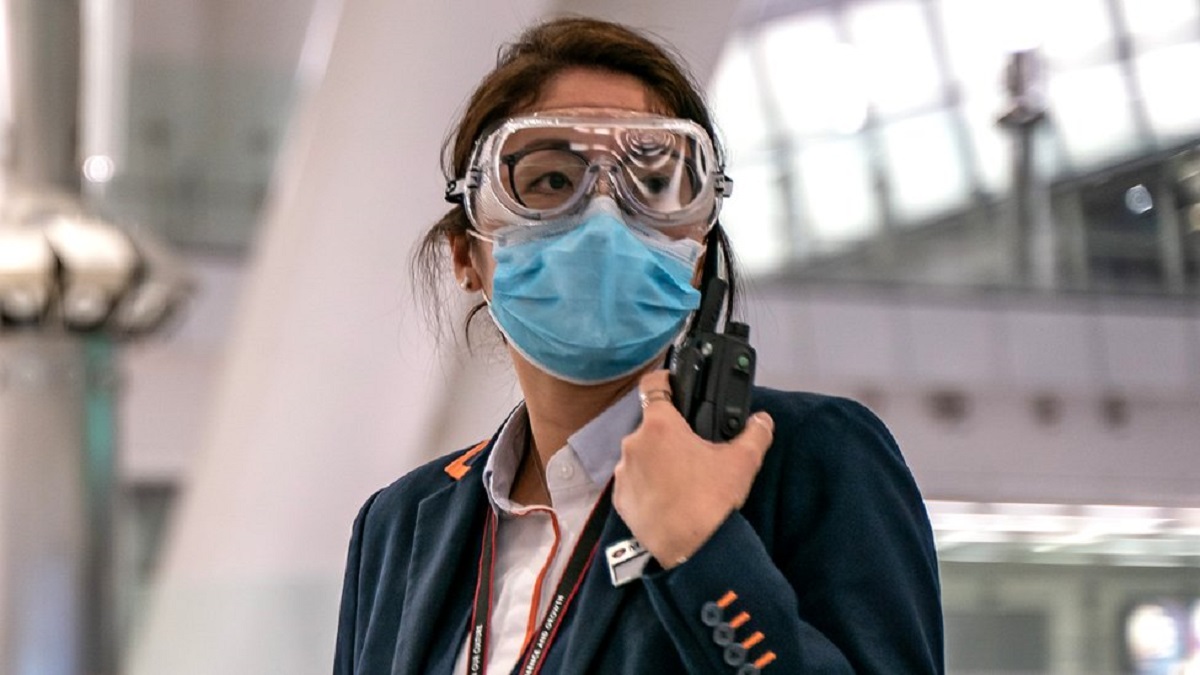

Guaranteed Rental Returns in Cambodia came at a time when the real estate market was booming. Business travelers and tourists were flying in and Cambodians from the countryside were flocking to big cities like Phnom Penh to find work - constituting a large base of property buyers and renters. But COVID-19 has disrupted this growth.

So can the developer reduce the GRR under certain situations? Can the developer altogether stop paying the GRR if there’s a force majeure event? “It depends,” says Jay Cohen. He reminds investors that the GRR is a contract between the purchaser and the developer. “Whether the developer is allowed to reduce the GRR because of events like a pandemic, or a force majeure event, that really comes down to the nature of the contract”.

Cambodia has legal concepts of force majeure. Jay says that developers may rely on this law but warns this may be a difficult issue as it is not clearly spelled out under Cambodian law.

He suggests that a “dispute resolution” be negotiated between the investor and the developer. “Give some thought to dispute resolution,” he said, “the agreement may be regulated by Cambodian law, and may give investors the choice of the Kingdom’s courts or arbitration”.

“Arbitration in Cambodia may be a good path as it’s faster. So that may be a way to enforce the agreement” he said.

Recap and additional tips when considering Guaranteed Rental Return offers

Jay Cohen reminds investors there should be a document aside from the Sale-and-Purchase Agreement (SPA) that clearly sets out the GRR, obligations of the developer, and any other additional expenses to be shouldered by the purchaser.

Additionally, even if a GRR is reasonable and competitive, they are not the sole indicators of a good investment. Saraboth Ea, Managing Director of Maxem Property warns, “GRR needs to be considered amongst many other factors that determine whether an investment is a good value or not. This will consider the buyer's objectives and investment timeline, which varies from individual to individual.”

“As the market matures,” continues Ea, “We hope to see developers put less emphasis on rental returns, and establish a good balance between local buyers who will reside in the property versus those who buy purely as an investment.”

Looking at both sides of the Guaranteed Rental Returns debate, the rental guarantee is important for investors who need immediate reassurance on their investment - however, the guarantee is only as good as the strength of the company offering it.

Ea says that a healthy skepticism around GRR is only natural in Cambodia, as it is a relatively new concept for local buyers and investors: “Rather than being the sole incentive for a buyer, we view it more as a gauge of the developer's confidence in their project.”

Article by:

Comments