Outcome of Trans-Pacific Partnership presents uncertainties and opportunities for flight-to-quality activities

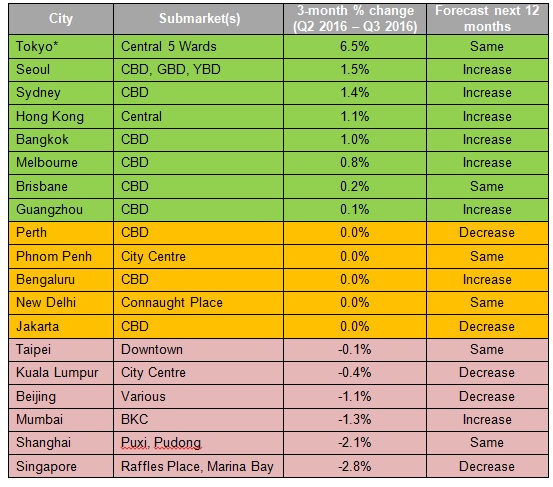

30 November 2016, Singapore – Knight Frank, the independent global property consultancy, today launches the Asia-Pacific Prime Office Rental Index for Q3 2016. The index monitors prime office rents in 19 cities across Asia-Pacific. For Q3 2016, eight cities registered positive rental growth, down from 10 in the previous quarter.

Results for Q3 2016

- Knight Frank Asia-Pacific Prime Office Rental Index grew 0.6% in Q3 2016 compared to the previous quarter as a result of rising rents in eight markets and rental declines in six markets.

- Tokyo continues to experience the highest rental growth, although demand is expected to taper off as a strong supply pipeline looms.

- Singapore sees the largest decline in rental due to slowing global economy.

- Going forward, we expect rents in 14 cities to remain steady or increase, unchanged from last quarter’s forecast.

- While it is still early days, the results of the US election is likely to lead to more uncertainty across the region, with the likely end of the Trans-Pacific Partnership (TPP) a blow to export-dependent economies.

Mr Nicholas Holt, Head of Research for Asia-Pacific, says, “The outlook for the regional economy is uncertain as the future of the TPP hangs. We expect a knock-on effect on office demand when export-driven economies are dealt a blow should the TPP be dissolved.

“Given the significant amount of supply coming into a number of markets, we do see opportunities for occupiers to upgrade into superior space, as the pendulum swings from landlord to tenant-friendly conditions.”

Download the full Knight Frank Report

Comments