Updated on: June 6, 2022, 5:05 p.m.

Published on: March 22, 2016, 4:17 a.m.

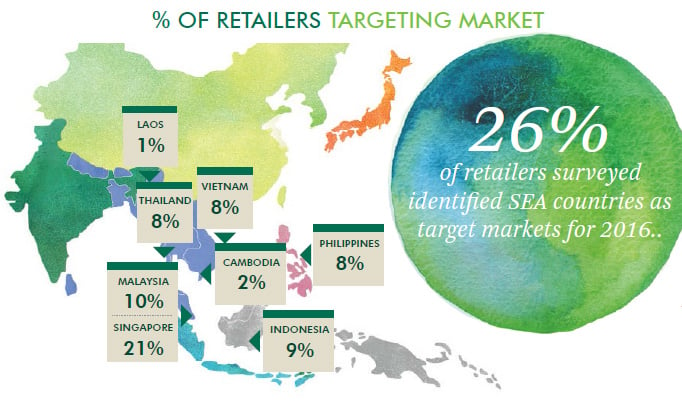

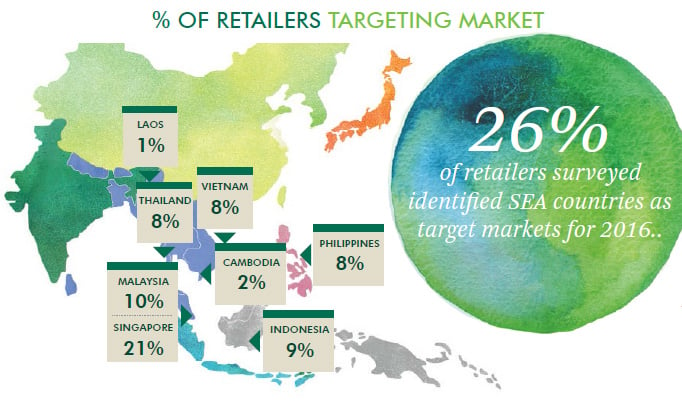

CBRE Research Southeast Asia has released the results of the 7th edition of the “How Active are Retailers report”. Within this report, statistics suggest that 26 percent of all global retailers surveyed identified Southeast Asian countries as primary target markets for 2016.

Retailers primary interests in the Southeast Asian region appear to focus on Mid-range Fashion and Luxury & Business retail sectors.

[caption id="attachment_81434" align="alignleft" width="225"]

Muyngim Lim, CBRE Cambodia[/caption]

48 percent of retailers particularly targeting the Southeast Asia economies come from Europe, ahead of the North America and Asia Pacific regions.

"The fact that 26% of global retailers surveyed identified South East Asia as a target market for 2016 expansion is highly encouraging, with European mid to high-end fashion retailers showing particular interest. While Cambodia is yet to attract the level of interest enjoyed by more developed South East Asian markets, 2% having noted Cambodia as a target market for this year, with the arrival of new high-quality shopping malls, combined with growing domestic disposable income, we are optimistic that Phnom Penh will continue to benefit from new retailer entrants over the course of 2016,’’ said Muyngim Lim, Analyst at Research, Consulting & Valuation at CBRE Cambodia.

In regards to potential effects on retail supply in Southeast Asia, according to the CBRE report, 65 percent of retailers have typical store size requirements of less than 500 sqm.

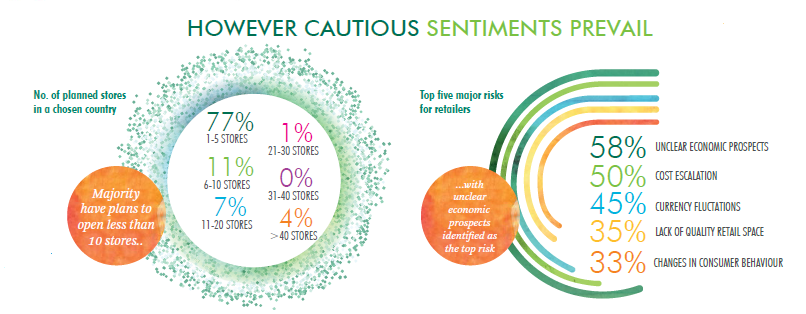

It is not all smooth sailing though for retailers targeting Southeast Asian countries; Cautious sentiments prevail with the majority of surveyed retailers targeting to open less than 10 stores in any chosen Southeast Asia country.

The top five major risks for retailers in Southeast Asia were UNCLEAR ECONOMIC PROSPECTS, COST ESCALATION, CURRENCY FLUCTUATIONS, LACK OF QUALITY RETAIL SPACE, LACK OF QUALITY RETAIL SPACE & CHANGES IN CONSUMER BEHAVIOR. Learn more about Phnom Penh Retail Space!

It is not all smooth sailing though for retailers targeting Southeast Asian countries; Cautious sentiments prevail with the majority of surveyed retailers targeting to open less than 10 stores in any chosen Southeast Asia country.

The top five major risks for retailers in Southeast Asia were UNCLEAR ECONOMIC PROSPECTS, COST ESCALATION, CURRENCY FLUCTUATIONS, LACK OF QUALITY RETAIL SPACE, LACK OF QUALITY RETAIL SPACE & CHANGES IN CONSUMER BEHAVIOR. Learn more about Phnom Penh Retail Space!

[caption id="attachment_81434" align="alignleft" width="225"]

[caption id="attachment_81434" align="alignleft" width="225"] Muyngim Lim, CBRE Cambodia[/caption]

48 percent of retailers particularly targeting the Southeast Asia economies come from Europe, ahead of the North America and Asia Pacific regions.

"The fact that 26% of global retailers surveyed identified South East Asia as a target market for 2016 expansion is highly encouraging, with European mid to high-end fashion retailers showing particular interest. While Cambodia is yet to attract the level of interest enjoyed by more developed South East Asian markets, 2% having noted Cambodia as a target market for this year, with the arrival of new high-quality shopping malls, combined with growing domestic disposable income, we are optimistic that Phnom Penh will continue to benefit from new retailer entrants over the course of 2016,’’ said Muyngim Lim, Analyst at Research, Consulting & Valuation at CBRE Cambodia.

In regards to potential effects on retail supply in Southeast Asia, according to the CBRE report, 65 percent of retailers have typical store size requirements of less than 500 sqm.

Muyngim Lim, CBRE Cambodia[/caption]

48 percent of retailers particularly targeting the Southeast Asia economies come from Europe, ahead of the North America and Asia Pacific regions.

"The fact that 26% of global retailers surveyed identified South East Asia as a target market for 2016 expansion is highly encouraging, with European mid to high-end fashion retailers showing particular interest. While Cambodia is yet to attract the level of interest enjoyed by more developed South East Asian markets, 2% having noted Cambodia as a target market for this year, with the arrival of new high-quality shopping malls, combined with growing domestic disposable income, we are optimistic that Phnom Penh will continue to benefit from new retailer entrants over the course of 2016,’’ said Muyngim Lim, Analyst at Research, Consulting & Valuation at CBRE Cambodia.

In regards to potential effects on retail supply in Southeast Asia, according to the CBRE report, 65 percent of retailers have typical store size requirements of less than 500 sqm.

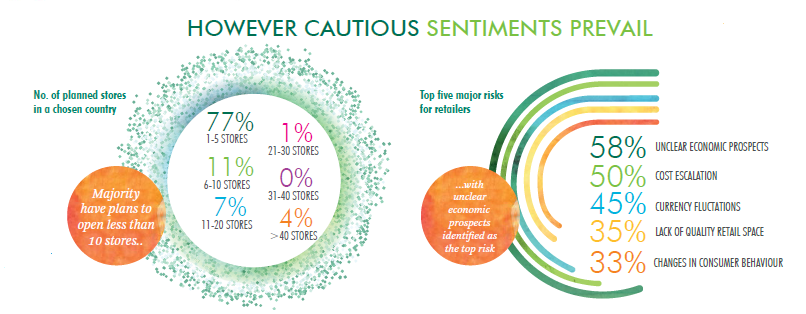

It is not all smooth sailing though for retailers targeting Southeast Asian countries; Cautious sentiments prevail with the majority of surveyed retailers targeting to open less than 10 stores in any chosen Southeast Asia country.

The top five major risks for retailers in Southeast Asia were UNCLEAR ECONOMIC PROSPECTS, COST ESCALATION, CURRENCY FLUCTUATIONS, LACK OF QUALITY RETAIL SPACE, LACK OF QUALITY RETAIL SPACE & CHANGES IN CONSUMER BEHAVIOR. Learn more about Phnom Penh Retail Space!

It is not all smooth sailing though for retailers targeting Southeast Asian countries; Cautious sentiments prevail with the majority of surveyed retailers targeting to open less than 10 stores in any chosen Southeast Asia country.

The top five major risks for retailers in Southeast Asia were UNCLEAR ECONOMIC PROSPECTS, COST ESCALATION, CURRENCY FLUCTUATIONS, LACK OF QUALITY RETAIL SPACE, LACK OF QUALITY RETAIL SPACE & CHANGES IN CONSUMER BEHAVIOR. Learn more about Phnom Penh Retail Space!

Comments