The release of the sixth Realestate.com.kh Cambodia Real Estate Survey indicates a number of leading trends within the market, and overall, a positive buyers sentiment in the Cambodia property and real estate sector for 2023.

With 2,000 respondents (both Cambodian and foreign) providing property insights about rental and purchase demand, spending power, consumer preferences, and locations of interest, we can garner some interesting insights for the coming year.

Who Is Looking To Invest In The Cambodian Property Market - Incomes & Desirable Price Ranges

A majority of respondents in the survey were over 21 years old and their range of professions and income suggest the nation is well on its pathway to achieving its middle-class ambitions.

Consumers with higher spending power were perhaps unsurprisingly notable among older Cambodians and foreign groups of buyers, but there remains interest among the youngest age bracket which indicates the future buying potential of younger Cambodians.

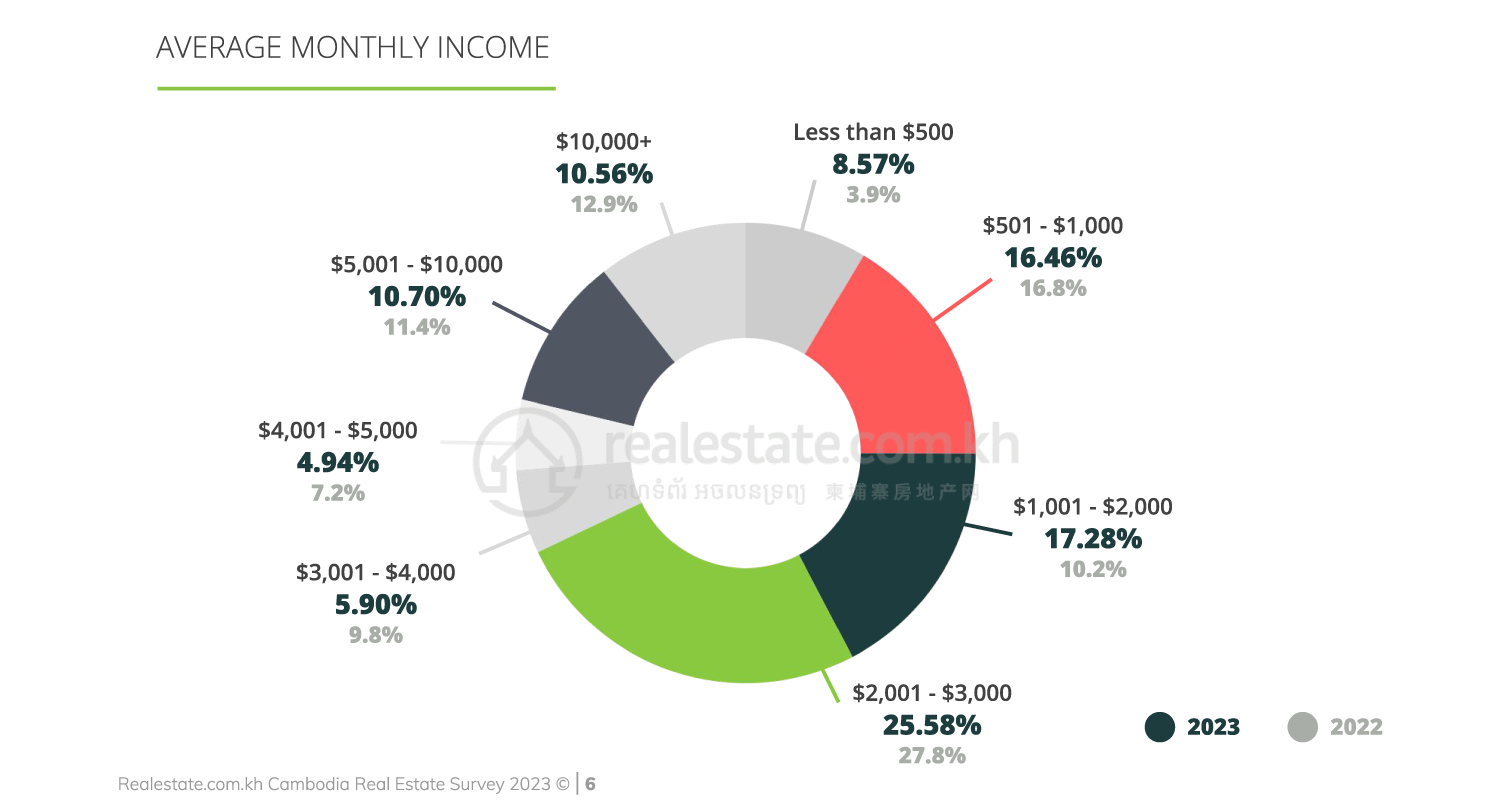

Most respondents in 2023 earned a combined household income of over USD $2,000 per month - which was a slight drop compared to last year. The slightly lower income was also reflected at the top end of the earnings for households earning USD $5,000+ per month.

Most households sit in the $1,000-3,000 monthly income bracket, and among foreigners, there was greater spending power with 42.5% indicating an income of over USD $5,000 per month.

In terms of living situations, the biggest change indicated was among those who lived on their own, which dropped from 26% in 2022 to 17.7% in 2023.

There is an increasing supply of apartments and properties, in general, available at more affordable prices - especially studio and one-bedroom condominiums in Phnom Penh. This suggests more young professionals are saving and looking into buying their first property.

In terms of property prices, the biggest representation among all respondents was 27% indicating an ideal Cambodian property price range is between USD $50,001 to $75,000. Among foreign buyers, the desired price range was USD $100,001 - $200,000, with more than a quarter expressing an interest in properties valued at $200,000+.

Property Market - Buyer Sentiments 2023

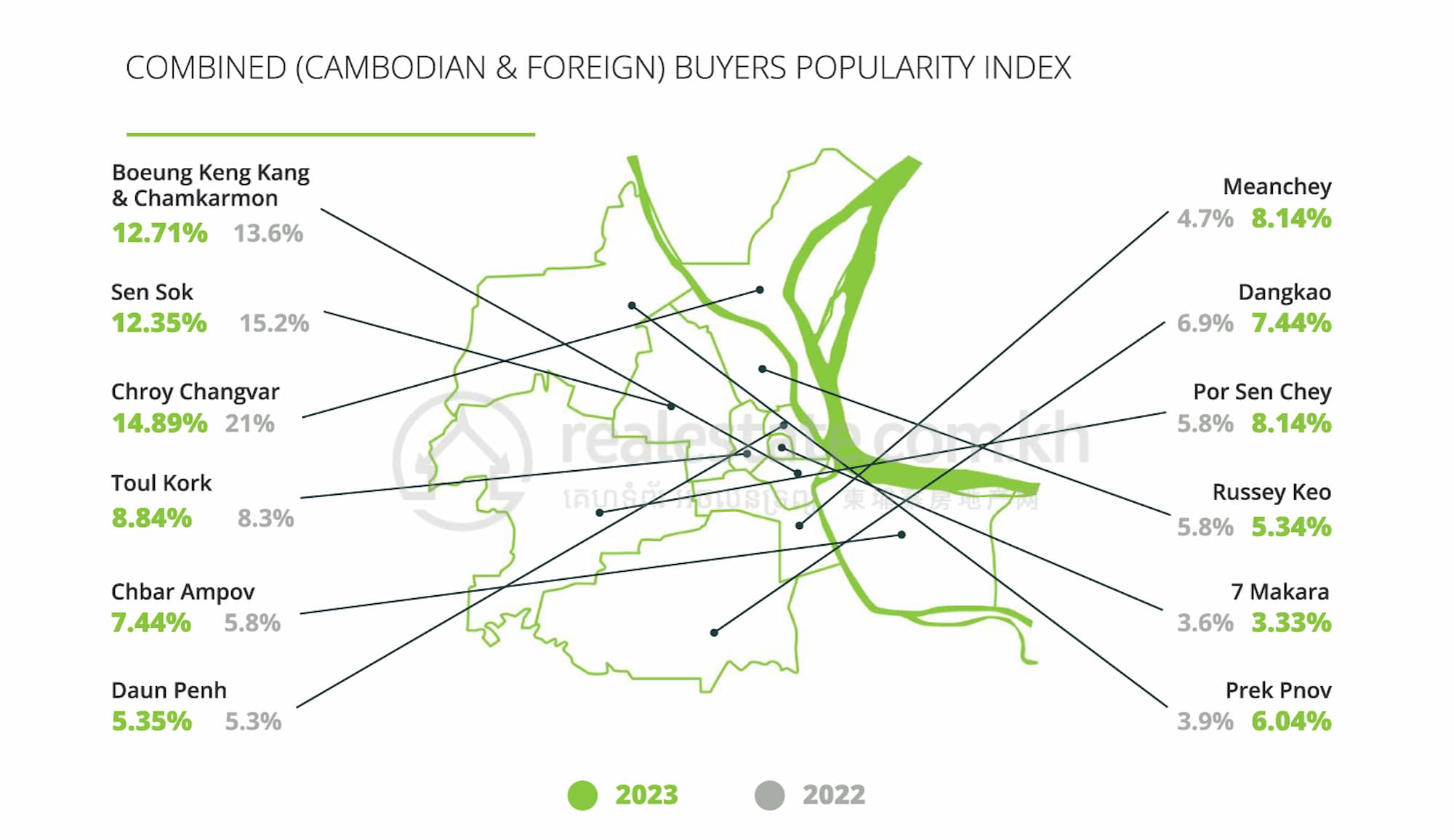

Phnom Penh remains the most popular area for all buyers, followed by Siem Reap & then Sihanoukville. Within the capital, combining interest from Cambodians and foreigners, the three areas most in demand to buy property in are:

- Chroy Changvar

- Chamkarmon / BKK

- Sen Sok

Cambodian buyers expressed interest in all twelve location options in Phnom Penh but foreign demand was concentrated among the three central locations of Chamkarmon, Daun Penh, and Toul Kork.

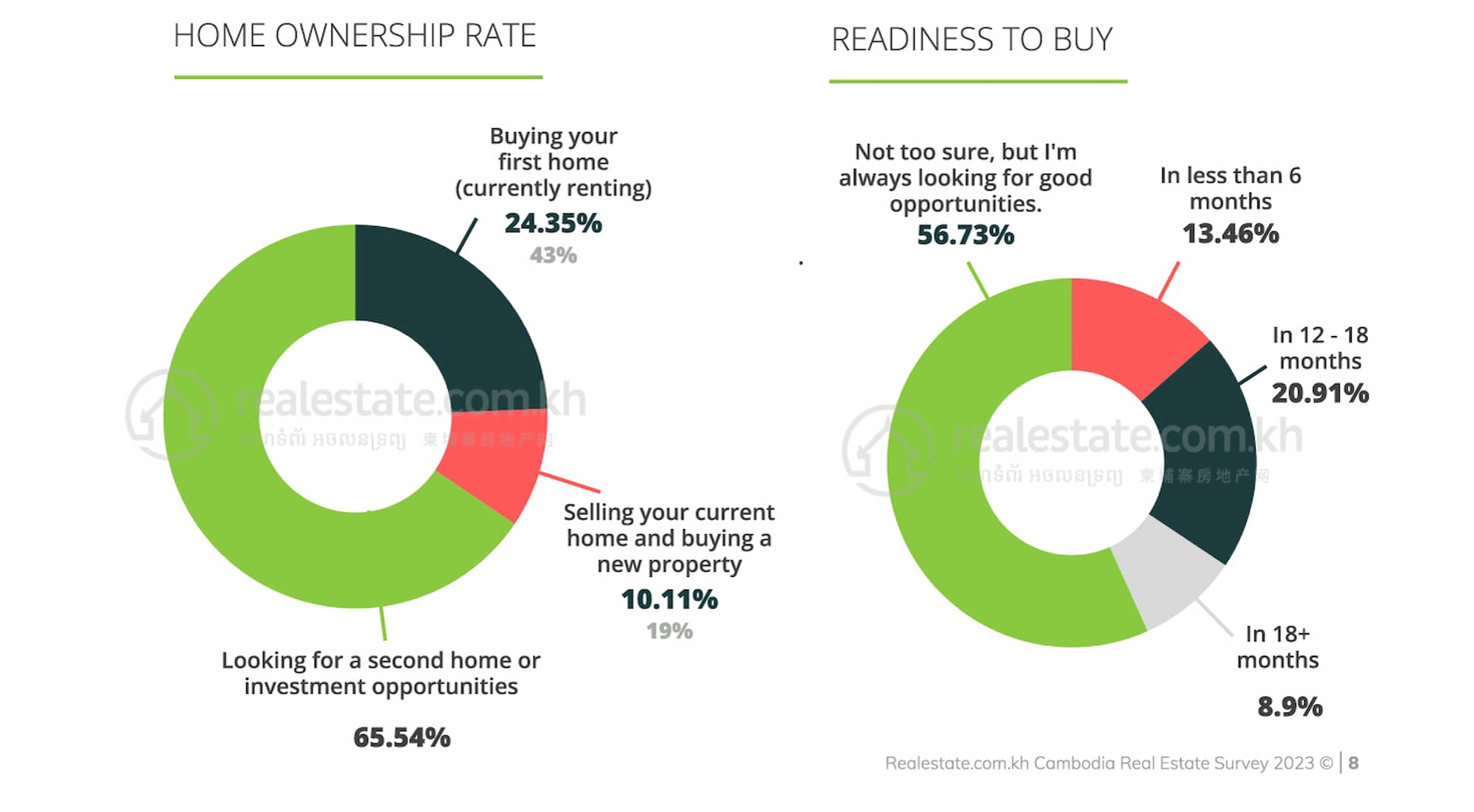

A quarter of the total respondents also indicated that they were renting a property but were looking to buy as first-time homeowners in Cambodia.

Although a majority of respondents indicated they would be more likely to buy their next home instead of renting - they were unsure of the timing. This reflects a combination of investors waiting for the opportune time to buy and first home buyers looking for the right signals to enter the Cambodian property market.

- A third of respondents were looking to buy property in the next 18 months.

- Nearly 15% indicated they were looking to buy more immediately (within 6 months).

- A majority (61%) felt property prices in Cambodia will increase over the next year, and a similar number felt property prices are currently affordable in the market.

Buyers Preferences

Cambodian buyers indicated investment in land as their top choice, and understandably, condos or apartments were most favoured by foreigners. The latter makes sense due to the ease of buying a condo versus other property types - international investors are seeking a strata-titled condominium development.

Overall (for new and older property types), while condos are in greater demand for all buyers, borey developments have seen a drop-off in interest across villas, shophouses and linkhouses.

However, among only newly finished developments in Cambodia - there was still strong interest in borey properties - potential buyers express far greater confidence in buying a condominium or landed gated property that is complete or nearing completion.

In previous surveys, the location of a property or development was the top consideration for buyers, but this year, the “quality of the property” was ranked as most important, followed by return on investment, location, price, and low-interest rates.

Rental Market in Cambodia

Once again, Phnom Penh was overwhelmingly the most desired location to rent in, with 70% of all respondents indicating the city as their top rental location, although this dropped compared to 2022.

The next three most popular locations in the Kingdom to rent in all saw an increase of interest (most doubling); Siem Reap (9.3%), Kampot (8.6%), and Sihanoukville (4.7%). There was also some marginal interest in Kep and Takhmao.

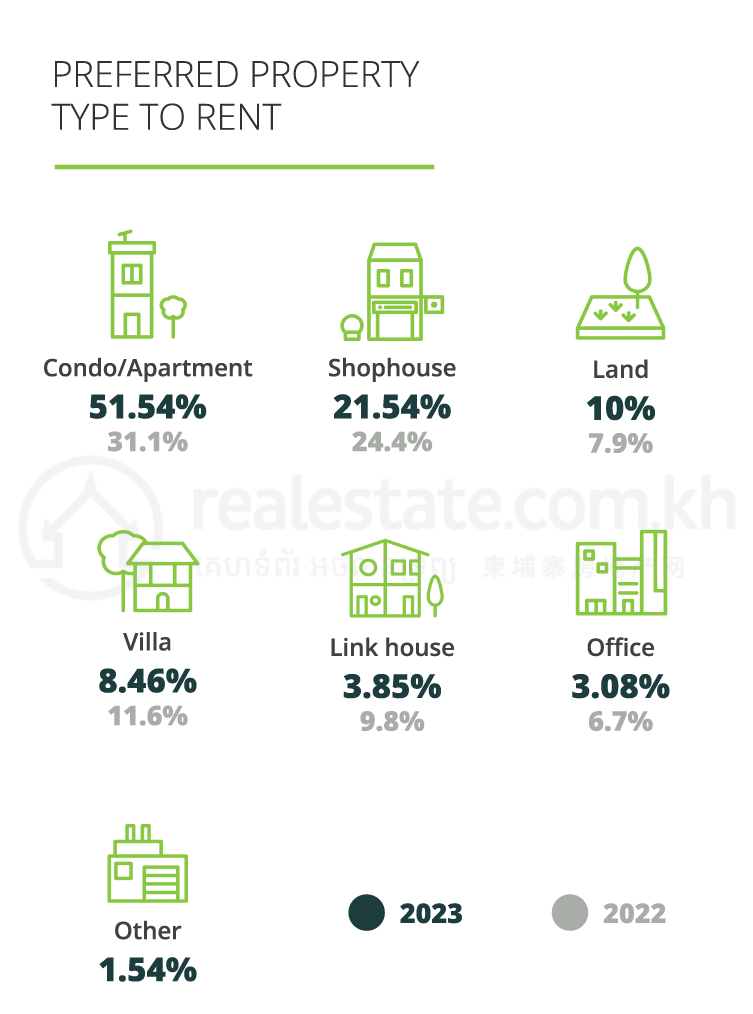

Similar to the buyer market sentiments, condos and apartments were the most popular among renters, with more than half indicating these properties as their top choice - with the biggest percentage to date since the surveys started.

- Among only the Cambodian rental respondents, shophouses accounted for as much as 60% in 2023, with land the second most popular at 25%.

- Among foreigners alone, condos and apartments remain the most favourable (74%).

Chamkarmon / BKK were the most popular areas to rent in the capital among all respondents, with a quarter indicating so, but the areas are especially in demand among foreigners (58%).

When asked what the most important factor was when looking for a property to rent, security, price, noise, and services were key considerations in that order. Preferences varied slightly when comparing Cambodian renters to foreign internationals, but price and noise remained the major concerns for both groups.

Finance & Insurance In the Cambodian Property Market

There is a sense that property buyers continue to be better informed and knowledgeable in financial literacy and the requirements for purchasing properties in the Cambodian market.

The unrealistic expectations of buying a home with a 0% down payment are constantly declining and a majority of respondents indicated that they do require a mortgage in order to purchase property in Cambodia. Cambodian banks usually require developments to be close to completion before providing buyers with finance - these were reflected in the buyer's sentiment and preferences stated earlier.

The insurance industry has seen robust growth in the Kingdom over recent years and an increasing number of companies are entering the market offering more competitive and broader range of products.

This year, more than half of respondents suggested they would be seeking property insurance and the coverage of the policy was deemed the most important consideration. The ease of acquiring the insurance was the lowest priority and this suggests an opportunity for more established property insurance companies to make their way into the Cambodian property market.

Changes In The Property Industry

In terms of what changes the market would like to see in the Cambodian real estate industry - this year the need for more affordable housing again was the most important selection - with one-third of all responses backing this.

The 2023 survey reflects a generally upbeat mood among investors and buyers in the Kingdom’s property sector. There are some key preferences indicated, in terms of location and types of property, but there are also a healthy number of investors and first-time homeowners looking to enter the market.

They appear to be doing so with a positive financial outlook, appreciation of risk, and within a reasonable timeframe - while equipped with the household income and current property prices suggesting a good match for affordability.

Comments