Following recent scares in the US and European banking sectors with the US collapse of Silvergate Bank, and then state-chartered commercial bank Silicon Valley Bank’s (SVB), First Republic Bank (a commercial bank and wealth management services provider) was bailed out by a dozen lenders who deposited $30 billion to shore up liquidity. Europe was next in the sights as Swiss UBS was asked to agree to buy its embattled rival Credit Suisse for $3.2 billion as part of a government-backed, cut-price deal.

Global markets have been jittery but the National Bank of Cambodia (NBC) made it clear that there’s no reason to be “panic” at a time when the country (like most of the region) is trying to regain economic ground lost during the pandemic. So how stable is the Cambodian banking and financial sector?

Prime Minister Hun Sen has also publicly said that the SVB’s collapse will neither affect Cambodia’s economy nor the banking sector, while Chea Serey, the new Deputy Governor of NBC, added, “We do not need to panic like them as banks in our country are strictly supervised… However, on behalf of the authorities, we still keep tracking whether or not it would affect our economy and how it would affect us.”

Prime Minister Hun Sen confirmed that banks in Cambodia had enough reserves to withstand the risks under the National Bank of Cambodia’s reserve requirement policy. “I urge anyone who has deposited money in a [local] bank not to panic. We call on the people to place their trust in [regulators’] abilities to manage the Cambodian banking and financial sector – banks have enough reserves to resolve any issues,” the premier stated.

One of the main fears all governments want to avoid is the panic withdrawal of funds from their bank accounts amid concerns - as many still have the deep wounds from the financial crises in their psyche - from both the 1997 Asian financial crisis and the 2008 global financial crisis - the latter of which had a minimal direct impact in Cambodia.

Cambodian Financial Market Stability

Stephen Higgins is the Co-Founder & Managing Partner of Mekong Strategic Capital and has more than two decades of experience in banking and financial services, communications, leadership, and strategy. He specialises in financial services and renewable energy, and has advised on some of the largest transactions in Cambodia in recent years.

At the start of the year, Higgins commented on the strengths of the Cambodian finance sector, following the market report on Cambodia’s financial sector's strong loan growth during the pandemic.

RRRs are central bank regulations that set a minimum amount of cash which financial institutions must hold in reserve. The Cambodian RRRs for foreign and domestic currency deposits currently stand at 12.5 per cent and eight per cent, respectively, according to the NBC.

Higgins indicated that the local financial sector showed remarkably strong performances during the pandemic, and although 2023 is likely to be a little more challenging (as it will be for many countries globally), for long-term investors the underlying fundamentals are still really strong. He remains confident that in the long-term, Cambodia will continue to be one of the highest growth economies in the world.

He had also pointed out that liquidy would be tighter as the loans for the past two years had been high in the Kingdom. Most loans in the Cambodian financial sector are also secured against collateral.

“There’s a big issue with liquidity in the local market, as there is regionally, but that was happening well before the SVB collapse. This is why deposit rates are going up so much, everyone is fighting very hard for deposits” he told us. “We don’t actually expect much, if any, impact on the sector here from the SVB collapse and the problems that have followed. Banks generally have pretty big capital buffers in Cambodia, and most are owned by big foreign parent banks who wouldn’t let a subsidiary fail.”

In terms of the Cambodian properties sector, we asked if he felt there were any concerns, especially in terms of loans and refinancing of loans in Cambodia. “Getting a loan is harder now, and interest rates are going up, so it’s not a great time to look for a home loan and even worse time to be trying to refinance a loan.

Still An Opportunistic Time To Buy In Cambodia?

Buyers with cash savings, and in particular overseas investors, have seen this as an opportune time to purchase while property prices are down in the Kingdom, and realestate.com.kh for example has been closing several sales to these groups of buyers.

Their EXPO 2022 event saw $30 million in property sales over 2 days, and as we wrote at the turn of the year, although trends suggest the domestic property market matured during the pandemic – foreigners are still the main force of real estate investment in Cambodia.

One of the concerns has been a potential market oversupply but this means buyers are able to shop around and purchase at great prices - combined with the fact that it's hard to access loans - it offers cash buyers a great time to buy.

Investors in particular can identify good opportunities, and as renowned investor Warren Buffet said “be greedy when others are fearful” - the indicators suggest it could be a good time to buy as the markets are comparatively down and the upturn is on the horizon.

In terms of his long-term outlook, Higgins added: “Sector loan growth has been too high and too easy for many years now, which can lead to complacency and some banks getting flabby. A period of low growth this year will actually be beneficial for the long-term health of the banks. We’ll have another year (2023) of below-trend growth, before an expected bounce back next year. Longer term, we’re still really optimistic about the outlook for Cambodia and expect it to be one of the highest growth economies in Asia. Just not this year.”

To calm any nerves, Higgins is yet another leading figure who says lessons have been learned from the 1997 Asian financial crisis and the 2008 global financial crisis - adding that the Cambodian finance sector is well capitalised “and for the most part, it’s conservatively run.”

The banking and financial sector has also shown good performance compared to ASEAN peers in terms of financial growth and stability.

Cambodian Property Demand 2023-2024

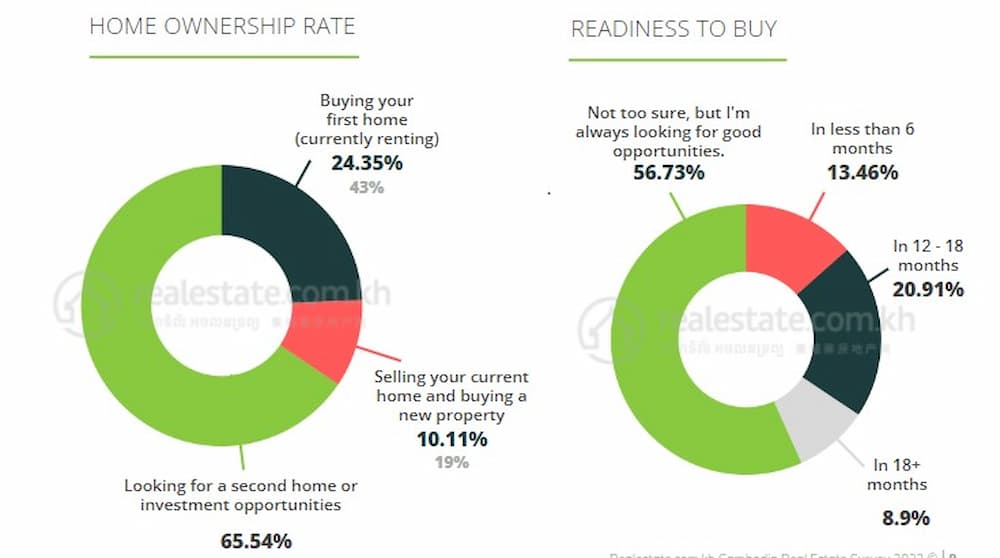

In the recently released Cambodia Real Estate Survey 2023 - we saw some trends and market sentiment indicators which suggested a number of buyers and investors were actively looking into buying in the market.

- A third of those surveyed are looking to purchase Cambodian property within the next 18 months.

- As many as 15 per cent indicated that they were looking to buy within six months (the first half of 2023).

- A majority (61%) indicated that they felt property prices would be increasing by 2024.

59% of those looking to buy a property acknowledged that they will need a loan or mortgage to do so. - As many as 43% indicated they will have a downpayment of 20% or less.

- Nearly two-thirds indicated they were still actively looking for second homes or investment opportunities in Cambodia.

Cambodia is still forecast to have the highest GDP growth rate among all Asian economies in 2023 according to the IMF (International Monetary Fund).

In addition, online searches for property in Cambodia remain strong from a variety of buyers, including high-net-worth individuals who don't require loans.

With property prices currently down before a perceived rebound, it remains a good time to make an investment in the right property in Cambodia but it would also be a good time to shop around for the right financing to see if your home loan and savings won't be stretched beyond your means.

Comments