With 2025 upon us, the Cambodian property and real estate market is poised for another year of challenges and opportunities in the backdrop to what should be a successive year of economic growth for the Kingdom of Cambodia.

Cambodian Economic Outlook for 2025

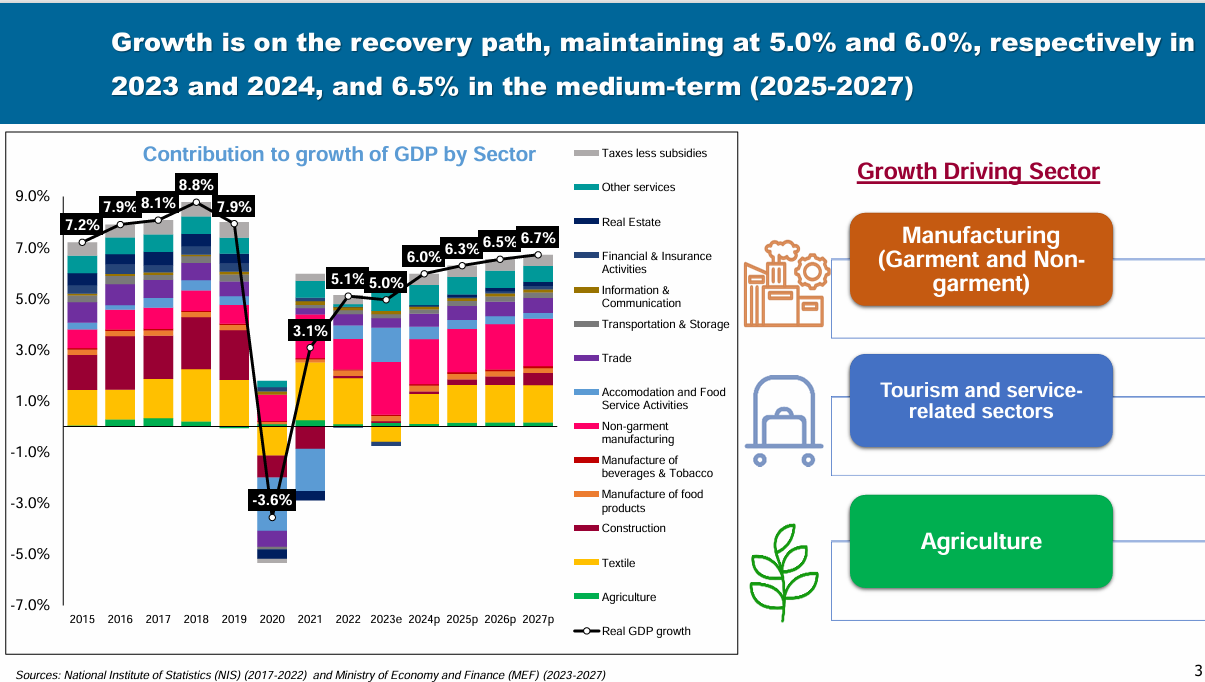

Cambodia reached approximately 5.3 per cent growth in 2024 and increased tourism development as well as exports were the main drivers.

According to the World Bank’’s most recent predictions, they see short-term growth of 6.1 per cent in 2025 and 6.4 per cent in 2026 for Cambodia. The Cambodian government foresees more optimistic growth projections, forecasting an economic growth rate of approximately 6.3 per cent in 2025, while the Asian Development Bank predicts a 6 per cent growth rate.

The Asia Pacific region is expected to average 4.4 per cent GDP growth in 2025 suggests the International Monetary Fund (IMF) and the World Bank

According to the General Department of Customs and Excise (GDCE), Cambodia’s international trade reached nearly US $50 billion in the first 11 months of 2024. This is a 17.4 per cent increase compared to the same period in 2023 with exports accounting for 48 per cent of the total trade volume, and exports and imports combined reaching US $23.93 billion and US $25.94 billion, respectively.

The property market has not yet experienced a resurgent revitalisation since the pandemic and prices have seen market corrections. However, the import of construction materials was just under US $1.5 billion in the first 11 months of 2024, which was more than a 22 per cent increase compared to 2023 reported the Ministry of Commerce (MoC). The data also reflected that more than 500 construction projects in the first ten months of 2024 had a combined investment capital of over US $1 billion.

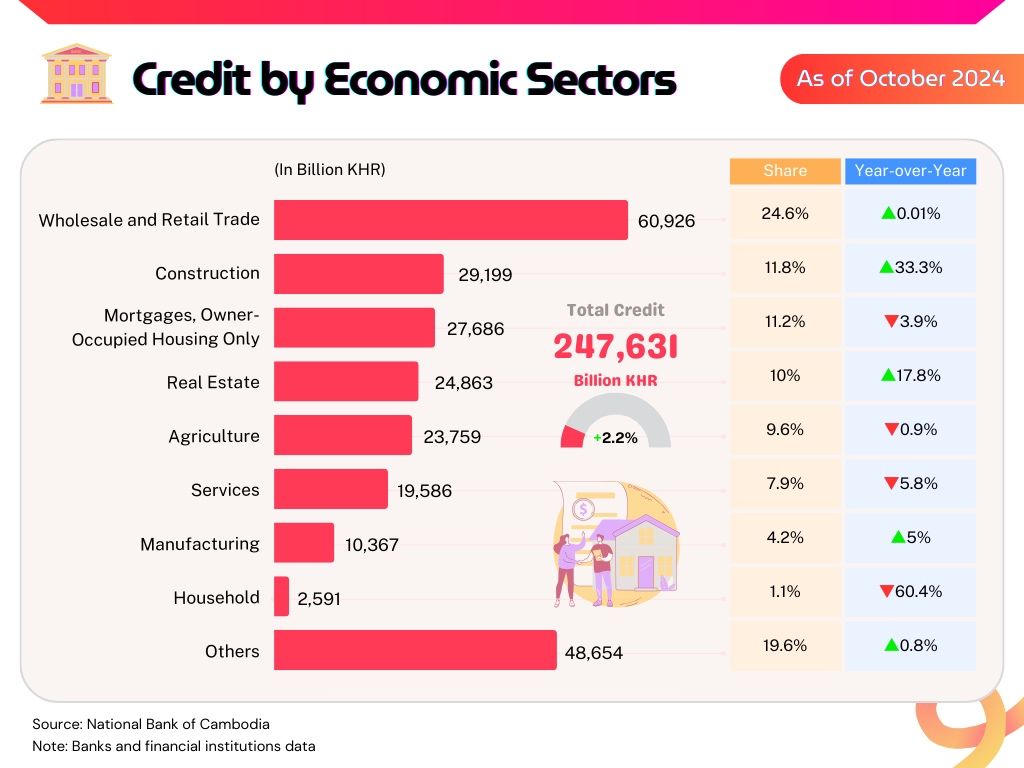

The National Bank of Cambodia announced that in the first ten months of 2024, the total credit provided by banking and financial institutions to the economic sector amounted to 247,631 billion riels (equivalent to US $60.9 billion). This was a 2.2 per cent increase compared to 2023 and the NBC says this was primarily driven by the increase in lending to wholesale and retail trade, construction, real estate, manufacturing, and other sectors. This was their most recently released update.

The Ministry of Economy and Finance (MEF) anticipates that the overall construction sector is projected to have grown by 1.1 per cent, and the real estate sector by 1.2 per cent in 2024.

The grand totals for 2024 should be known by the end of January 2025 if not before but the direction of the trade is moving in a positive direction.

Read more in our Guide to Real Estate Investment in Cambodia

Cambodia Infrastructure Projects Key Driver For Construction Growth

Global market research agency Research And Markets have indicated in a new report that Cambodia’s construction industry will record a growth of 5.8 per cent in real terms in 2024 and 6.8% in 2025.

Based on the Development of Cambodia (CDC) report published in November 2024, the government approved more than 340 fixed-asset investment projects worth more than US $5 billion in the first ten months of 2024 (which is incorrectly marked as a much higher figure in the report, so take heed of the reports findings) in a range of sectors spanning from hotel development, hydroelectric power, freshwater ports, solar power plants, lighting and accessory factories, among others.

As such, the report’s analysts anticipate the Cambodian construction industry will reach annual growth of 7.3 per cent from 2026 to 2028, which is largely driven by the large-scale infrastructure project which supports the investment as part of the master plan for Cambodia's transport and logistics system 2023-2033 which has identified 174 priority projects, although funding for many of these is still being sourced.

The Comprehensive Intermodal Transport and Logistics System master plan has an investment price tag of US $36.6 billion.

Stamp Duty Exemptions Increased In 2025

As of January 1 2025 and lasting until the end of the year, the MEF implemented a policy for exemptions and preferential stamp duties on the transfer of ownership or possession of real estate for first-time home buyers but the value of the eligible properties has been increased since these were first announced in 2024.

Purchases of a townhouse or condominium (single homes only) before 2025 and transfer ownership or occupancy rights in 2025 shall receive a stamp duty exemption on the transfer of ownership or possession of real estate.

Full Exemption applies for homes valued at US $210,000 or less, and for those valued above $210,000, the first $210,000 will be exempt from the stamp duty base. This is a change from the prices announced in November 2024 which set the exemption on homes with a price of $70,000 or less.

When these exemptions were first announced late in 2024, Prime Minister Hun Manet expressed the hope that the extension and addition of tax incentives until the end of 2025 will help housing developers and property owners and drive the growth of the real estate sector in the country.

It had already been previously announced that the implementation of the capital gains tax on specific types of income, including lease agreements, investment assets, intellectual property, goodwill, and foreign currency, has been again delayed until the end of 2025.

Cambodian Condo Prices On the Move?

It is not easy to get uniform data on land and condo prices but there are some seasonal reports released throughout each year in Cambodia. Keep in mind that in 2025, the condominium supply in Phnom Penh is projected to increase significantly, reaching approximately 80,000 units if all developments stay on course.

According to CBRE Cambodia’s ‘Average Land Prices in Phnom Penh by District in H2 2024’ report released in late November, demand has held prices high in 2024 and the capitals central Sangkats such as Daun Penh and Chamkarmon remain in the highest demand and thus the highest prices. Other areas are benefiting from improved amenities, transport links and infrastructure projects.

According to one property consultant, he tracks the pricing for condos in Phnom Penh as:

- Affordable condos - Average price/sqm: US $1,300

- Mid-range condos - Average price/sqm: US $2,000

- High-end condos - Average price/sqm: US $2,700

Another property firm suggested that the average developer’s selling price dropped from around US$1,500 to US$1,300 price/sqm of net saleable area in the first half of 2024.

Top Property Condo Handovers Expected In Phnom Penh In 2025

What Are The Challenges in 2025

The challenges heading into 2025 have not changed much in the past few months.

The new leadership in the United States under Donald Trump and his threats of tariffs and trade could impact the economy in the region, particularly in China. The latter is still struggling post-pandemic and although Cambodia has been trying to diversify, China remains a key trading partner, investor and source of tourism.

If there is an anticipated global economic downturn, particularly influenced by China's economic performance and tightening monetary policies worldwide, this will pose a significant risk to Cambodia's export-driven economy.

Geopolitical tensions and conflicts in Europe and in the Middle East continue to be disruptive and cause for concern and could impact trade and security.

Non-performing Loans (NPL) and credit risk have been a cause for concern throughout 2024 and will still need to be addressed in 2025.

Comments