With several economic and sector reports being released over recent weeks as we passed the halfway mark of 2024, we look at some key reports on the Cambodian real estate and property sector, which includes the CBRE H1 2024 report released in July, as well as official government data.

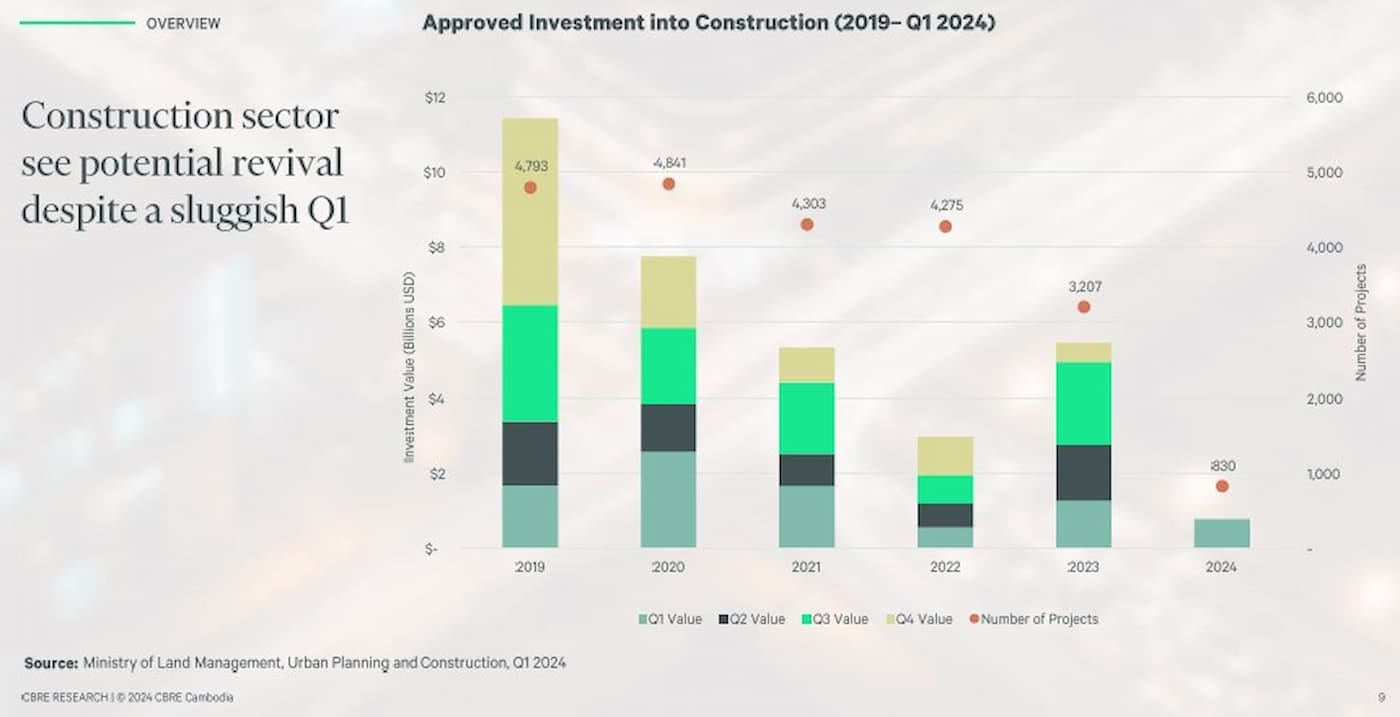

Approved Cambodian Construction Projects Jan-May 2024

According to the Cambodian Ministry of Economy and Finance “Socio-Economic Trend Report” for May 2024, there have been to date 1,330 approved construction projects which cover an area of 4.278 million sqm, which represents a 23 per cent decrease in the number of projects and a 9 per cent decrease in the total area compared to the same period in 2023.

The total value of the approved projects is USD $1.81 billion, which represents a drop of 20 per cent from USD $2.27 billion compared to 2023.

These projects are broken down as follows:

- 1,095 housing developments (1,061 boreys and 34 condominium projects)

- 88 industrial developments

- 90 commercial projects

- 21 tourism-related projects

- 35 public developments

- 1 investment project

Conversely, there has been a 23.1 per cent rise in the import of construction materials, while domestic cement production has increased by 4.7 per cent (3.5 million tonnes) over this period.

Iron and steel imports were worth approximately USD $296 million which is an increase of more than 50 percent in 2023.

CBRE Cambodia Real Estate Mid-Year Review 2024

CBRE Cambodia released its 'Phnom Penh Mid-Year Review 2024’ once again covering office, retail, condominiums, landed properties as well as industrial and logistics segments of the market.

They reported that Cambodia's construction sector saw a potential revival despite a sluggish performance at the start of 2024 which indicated the market was still flat with retail and office occupancies stable but with room for improvement especially with new supply entering the market.

The condo market continues to see new units enter the Phnom Penh housing market with as many as 14,000 units expected before the end of the year, while the industrial and logistics real estate sector saw 120 hectares of new launches being driven by manufacturing and the number of new commercial and trade deals the government has been entering with other nations to spur investment and economic growth.

Phnom Penh Office Rental Rates & Occupancy Are Steady

According to CBRE, Phnom Penh’s office rental occupancy was 61.8 per cent in H1 2024, while the CBRE 2023 mid-year report indicated rental occupancy in the Cambodian capital was 58.3 per cent.

Compared to cities such as Bangkok and Ho Chi Minh where the CBD has 80 per cent occupancy, Phnom Penh is lagging and CBRE added that the supply of office space for rent continues to grow. Of note, over a third (35 per cent) of the total supply is expected to be Strata-titled by the end of 2024.

Office Rental Rates In Phnom Penh

The cost per square meter (sqm) decreased for the first half of 2024 compared to the same period in 2023, with the current price range in the Cambodian capital for office rentals sitting at between USD $25-30/sqm. The office supply is expected to increase by 198,000 square metres in 2024, with 31 per cent of this new supply already completed H1 2024.

In Bangkok and Ho Chi Minh, rental prices increased compared to H1 2023; Bangkok's price range exceeds USD $30-35/sqm, while Ho Chi Minh City's average price was above USD $45.

Office rental rates are approaching the bottom end and expected to maintain at that level, with Grade A and Grade B office rental prices above USD $20/sqm (H1 2023 Grade A office rental prices were USD $26.5/sqm. Grade B (NCBD) and Grade C (CBD & NCBD) were around USD $15/sqm or less.

Grade B (NCBD) growth rate half-over-half (H-o-H) was up 6 per cent which was the biggest increase.

Recently completed office projects in Phnom Penh include Versailles Square and Maline Office Park, while upcoming projects include Chief Tower and the General Department of Taxation ‘GDT Tower’ project.

From the energy sustainability aspects, the number of Leadership in Energy and Environmental Design (LEED) Certified Projects in Cambodia numbered 28 such projects, which is noticeably lower than other regional cities, according to data from the U.S. Green Building Council. There are sentiments that future projects are being developed with sustainable features a key consideration.

Challenges Remain In H1 2024 - Retail

Phnom Penh's retail rents and occupancy rates both remain lower compared to Bangkok and HCMC for example. Phnom Penh's retail real estate occupancy was slightly above 60 per cent, whereas Ho Chi Minh City's Non-CBD was nearly 90 per cent, and Bangkok and Ho Chi Minh City's CBD both exceeded 90 per cent.

Delayed openings have persisted due to sluggish take-up and the average H1 2024 occupancy rate for retail was 58.7 per cent (compared to 68.5 per cent in H1 2023).

Just under half (45 per cent) of the current supply are shopping malls in Phnom Penh but the food and beverage (F&B) sector continued to see new brand entries and expansions into the Cambodian market with more than 30 entries into the market but expansions is lower than the previous few years.

Creative marketing and activities are seen as areas to improve upon in this competitive space.

Retail Market Rental Prices - Phnom Penh

Phnom Penh rental rates were approximately USD $25, which is half the price of Bangkok’s CBD and one-fifth the cost of Ho Chi Minh City's CBD. Despite Phnom Penh's retail sector remaining more affordable it still faces challenges in occupancy rates, which CBRE suggests means there is room for growth and development in the Cambodian retail market.

Upcoming retail projects in the capital include 60M Community Mall, The Peak, and GDT Tower.

Condominium Real Estate - 14,000 Units Expected To Be Added To Phnom Penh By The End Of 2024

There has been a slowdown in new launches of condo projects in H1 2024, with 2,200 units completed ranging from affordable to mid-range projects. These include Times Square 7, Capital Center City, and L Tower TPP, while there were notably no high-end condominium launches during this period.

Of the existing condo projects in Phnom Penh the supply increased during the first six months of 2024 by 2,400 units - with as many as 14,000 units expected by the end of 2024.

CBRE Cambodia mid-year 2024 report suggests the condominium price half-over-half (H-o-H) for the affordable and mid-range types were down respectively by 9.9 and 5.9 per cent, while high-end condominium prices were up 0.3 per cent.

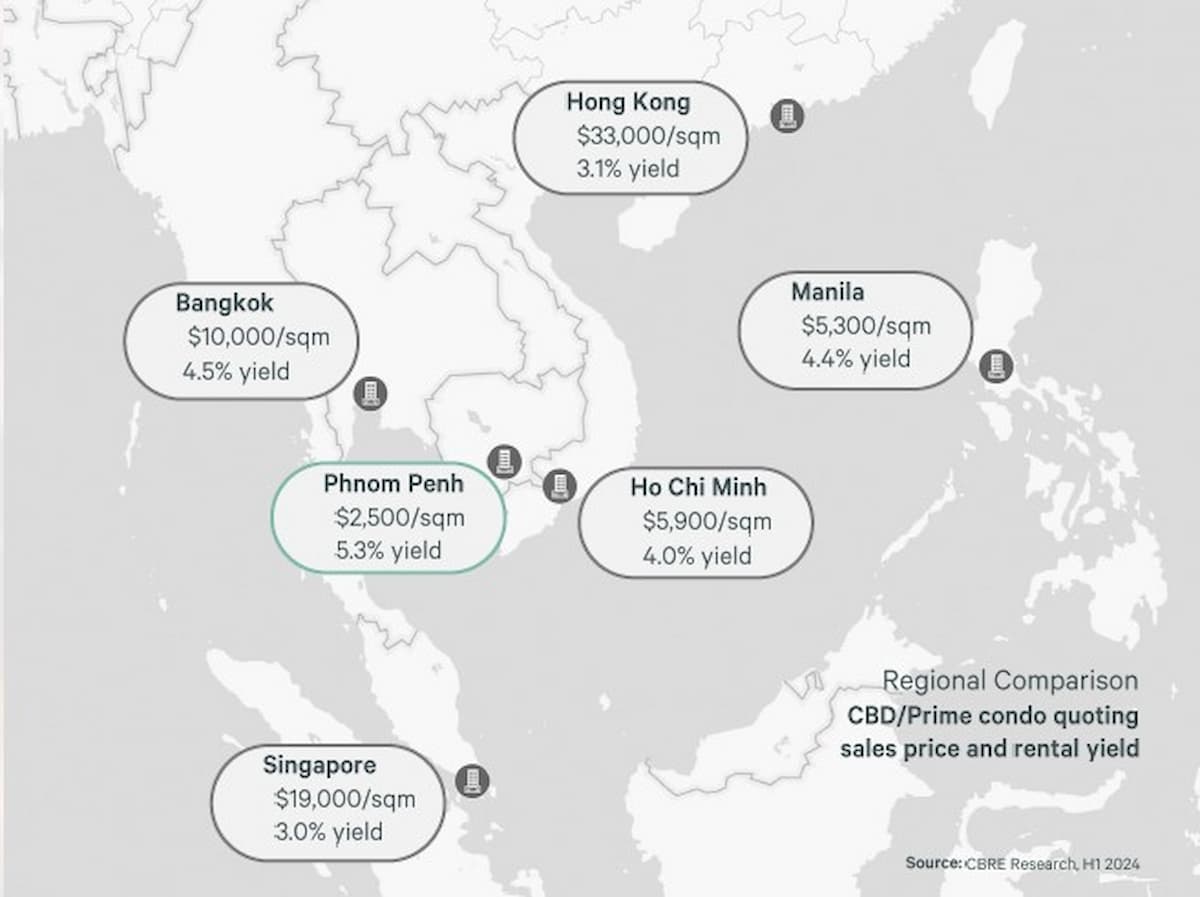

On the positive side, Phnom Penh offers the lowest sale price (USD $2,500/sqm) for condominiums and is among the best rental yields (5.3 per cent) compared to Bangkok, Hong Kong, Ho Chi Minh, Manila, and Singapore.

There has also been an increased interest from international brand residence operators while a decrease in international investors means greater demand from local buyers for affordable and mid-range properties.

Landed Property Market In Cambodia

New landed property launches experienced a slowdown in the first half of 2024 with 29 projects completed. The affordable landed properties made up 49 per cent of these followed by mid-range (44 per cent) and high-end (7 per cent) developments.

The Cambodian landed property developers are reluctant to launch new projects, and have instead extended the existing developments in 2024.

Industrial and Logistics Real Estate In Cambodia

Manufacturing is the main driver in this property sector in 2024 while the production of apparel (textiles, garments and footwear) leads the exports. The Cambodian government has been actively promoting the sector to boost investment, but CBRE says more needs to be done in the ease of doing business and trade competitiveness for investors to enter the market.

From 2019 to H1 2024, the average 50-year land lease has increased by 12.1 per cent - rising from USD $54.4 to USD $61 per sqm, while the rental costs of ready-built factories within the Cambodian Special Economic Zones have decreased by 6.2 per cent from USD $3.2 to USD $3 sqm

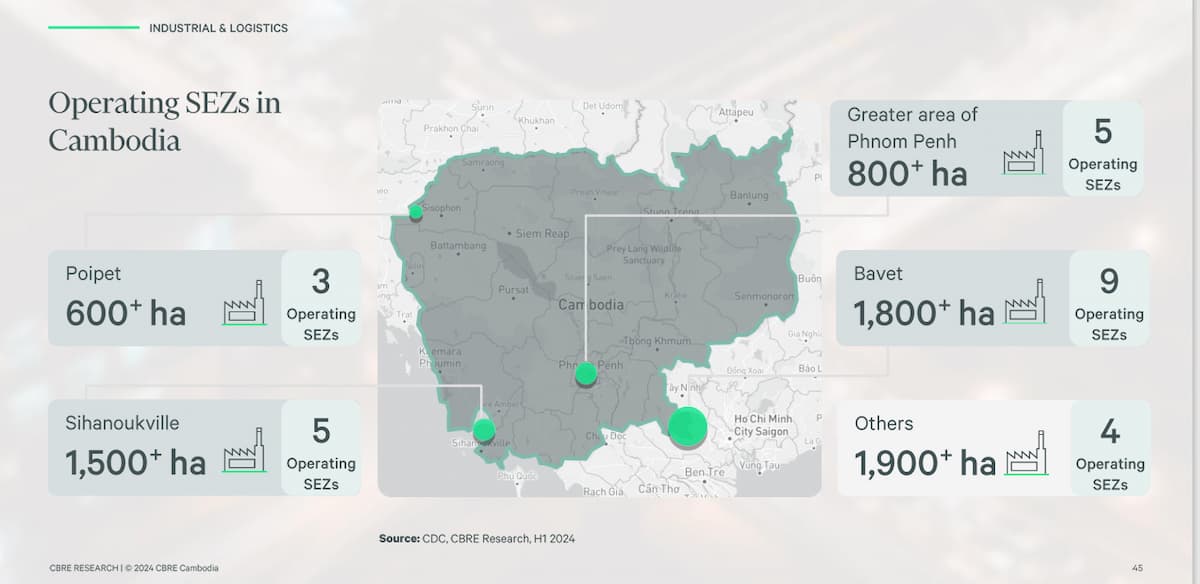

The Special Economic Zones (SEZ) made for interesting reading, as it has been widely reported that Cambodia has 54 Special Economic Zones (SEZs) but according to CBRE, there are currently only 28 operational SEZs in four major cities:

- Bavet City - 9 operating SEZs

- Phnom Penh - 5 operating SEZs

- Sihanoukville - 5 operating SEZs

- Poipet - 3 operating SEZs,

- Other Locations - 4 operating SEZs

There is nearly USD $36 billion tied up in infrastructure projects in Cambodia, with the congested pipeline until 2033 covering a range of improvements to transport and logistics as well as tourism.

Comments