While property appraisals are generally performed by skilled professionals, anyone involved in a real estate transaction can benefit from gaining a basic understanding of the different methods of valuation.

Investing in a property is a popular and quite effective way of securing and growing one’s wealth; especially if you see good returns from it in the long run. However, in order to make a proper investment, you must know how much you should invest in the first place.

Real estate evaluations can be tricky in the sense that a lot of factors have to be considered to assess their value. Fortunately, investing in Cambodian property is made easier with set standards and best practices in place.

Realestate.com.kh lays out the basics of calculating evaluation fees, and other important aspects you should consider when determining the value of a property you’re interested in.

How is Property Valued in Cambodia?

- The property valuation report includes all the features of the property and helps the owner, and prospective buyers, to understand its exact current condition.

- The goal of an appraisal is to determine a property's market value: the most probable price that the property will bring in a competitive and open market.

- An estimation of your property’s current worth or “market value” should consider any prior valuations of your property, suburb valuation trends, owner information, selling history, transfer history and comparable sales in the area.

- The property valuation gives an estimated market value of a property that is determined using various property industry sources, such as information from the relevant Cadastral office where the property’s title was certified, recent sales statistics, property-specific details, and relevant price trends.

- Unlike many consumer products that are consumed or perishable, the benefits of real property are generally realised over a longer period of time. Therefore, an estimate of a property's value must take into consideration economic and social trends over time, as well as governmental controls or regulations and environmental conditions that may influence that value.

Evaluators and their fees in Cambodia

Hiring an evaluator is recommended for property investors, mortgage lenders, insurers, and tax collectors. But before you go and hire an evaluator, you must know what to expect from them.

Here’s a quick list of things you should be expecting from a reliable property evaluator:

- Know the demand for that property - the desire or need for ownership supported by the financial means within the market to satisfy the desire;

- The utility of that property - the ability of your property to satisfy future owners' desires and needs;

- Scarcity - the finite supply of competing properties of a similar type and description;

- Transferability - the ease with which ownership rights over your property are transferred.

Evaluators in Cambodia are commonly paid based on a percentage of the assessed property value. You can also contact the Cambodian Valuers and Estate Agents Association (CVEA) for property evaluators.

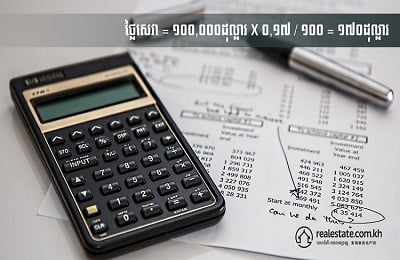

Below is the necessary calculation formula you should know when hiring an agent to evaluate your property in Cambodia.

Valuation fees

- When you sell your property and need a valuation firm to define your property’s value, these are the charges you should expect from your licensed Valuer:

- For a property that is valued below $100,000, you need to pay a valuation fee of 0.17% of the property value, or a minimum of $170;

- Property valued between $100,000 and $1,000,000 will be charged to you at 0.1%, or a minimum of $900;

- Property with a value between $1,000,000 and $5,000,000 will be charged to you at 0.05%, or a minimum of $2,000;

- Property with a value between $5,000,000 and $10,000,000 will be charged to you at 0.03%, or a minimum off $1,500;

- Above $10,000,000, you will be charged at 0.025% of the property value.

To clarify this, let’s take a look at some specific examples below:

Valuation Example 1:

Key Real Estate is a legal valuation firm. Mr. Vichet hires Key Real Estate to evaluate his property and he agrees to pay the price that the ministry has set. After doing the valuation, it is found that his property is valued at $1.5 million. So, how much is the fee?

Calculation breakdown:

- First $100,000 is applied: $100,000 X 0.17/100 = $170;

- And $900,000 is applied: $900,000 X 0.1/100 = $900;

- Then, $1,500,000 - ($100,000 + $900,000) = $500,000. So, the $500,000 X 0.05/100 = $250

- Now we can get $170 + $900 + $250 = $1,320.

In this case, Mr. Vichet needs to pay a valuation fee of $1,320.

Valuation Example 2:

Cambodia Properties Limited (CPL) is a legal valuation firm. Mr. Sovan hires CPL to evaluate his property and he agrees to pay the price that the ministry has set. After doing the valuation, it is found that his property is valued at $13 million. So, how much is the fee?

Calculation breakdown:

- First $100,000 is applied: $100,000 X 0.17/ 100 = $170;

- $900,000 is applied: $900,000 X 0.1/100 = $900;

- $4,000,000 is applied: $4,000,000 X 0.05/100 = $2,000;

- $5,000,000 is applied: $5,000,000 X 0.03/100 = $1,500;

- Then $13,000,000 - ($100,000 + $900,000 + $4,000,000 + $5,000,000) = $3,000,000. So, the $3,000,000 X 0.025/100 = $750

- Now we can get $170 + $900 + $2,000 + $1,500+ $750 = $5,320

So, Mr. Sovan needs to pay a valuation fee of $5,320.

However, while this is set for the general property valuations; note that some special properties such as factories and huge business properties have no set valuation fee.

Instead, it depends on each case and the calculation formula set out in the pre-agreement between you and the valuation firm.

Read more on the property taxes in Cambodia.

Benefits of a Proper Evaluation

- Selling your Property: If you want to sell your property in Cambodia and need to find out the appropriate price, using the services of a property valuator is the best choice.

- Buying Property: When you are interested in buying a new property and need to make a pre-purchase assessment of it, you can find all the information that you need by taking up the services of a property appraiser.

- Tax Compliance: In the case of tax-payment related matters, a valuation of the property by property valuators is necessary to determine tax liabilities fairly and openly.

- Assessing Rental Rates: In a situation where you wish to lease out your property and need to set an appropriate rental cost based on the qualities of your property, a property valuation service will be useful in determining the amount based on your property’s value.

- Legal Settlements: For the settlement of property rights between members of the family, matrimonial settlements, litigation settlements, etc. you need to know the appropriate value of the property in order to divide it fairly.

- Mortgages and Loans: In order to borrow money from the bank, you need to provide information about your real assets by which you can guarantee the loan. A good valuation will help guarantee your next loan or Mortgage.

- Insurance: When you have to get the value of your property for the purpose of insurance coverage and claims, nothing can get the matter through faster than hiring the services of professional property appraisers.

- Increasing the value of your Property: By understanding how your property's market value increases according to the criteria of the valuation report, you can upgrade features of the property to increase that value in time for the next valuation. A valuation report allows you to objectively analyze your property, and any business ventures attached to that property, and improve its market value.

Stay up-to-date on the real estate industry in Cambodia and get real-time updates on real estate news as they happen. Download the Realestate.com.kh App now!

Article by:

Comments