Unveiled in 2013 by Chinese President Xi Jinping, the Belt and Road Initiative (BRI) is an ambitious, trillion-dollar strategy that China is pushing across several continents.

The initiative, also known as One Belt, One Road, involves the construction of a massive network of ports, gas pipelines, highways, railways, dams, and related infrastructure across countries in Asia, Africa, and Europe.

For a deeper dive into the BRI and other investment topics go download our Investment Guide 2019.

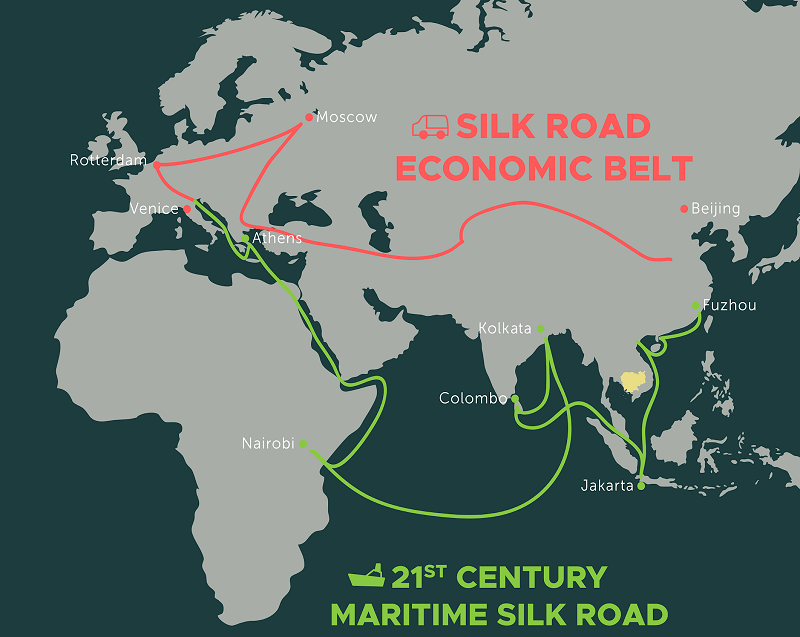

The initiative is divided into two major components: the Silk Road Economic Belt and the 21st Century Maritime Silk Road. The Silk Road Economic Belt will bring China closer to Central Asia and Europe, while the 21st Maritime Silk Road will see the South China Sea and the Mediterranean connected via the Indian Ocean and two important shipping channels, the Strait of Malacca and the Suez Canal.

The BRI includes six land corridors of economic integration:

- China-Pakistan Corridor

- New Eurasia Land Bridge

- Bangladesh-China-India-Myanmar Corridor

- China-Indochina Corridor

- China-Central Asia-West Asia Corridor

- China-Mongolia-Russia Corridor

Trillions of dollars

Many say the BRI is one of the largest infrastructure and investment projects in history. As of 2019, the BRI involves 71 countries, which account for almost 70% of the world’s population and more than 40% of the world’s $90 trillion GDP.

China has, thus far, invested between $1 trillion and $8 trillion into BRI-related infrastructure projects since the program was unveiled. Furthermore, figures promise to continue growing by leaps and bounds as more projects are approved.

Funding for BRI projects mostly comes from the Asian Infrastructure Investment Bank (AIIB), $40 billion Silk Road Fund (SRF), New Development Bank (NDB), and two of China’s biggest financial institutions, the China Development Bank (CDB) and Export-Import Bank of China (EIBC).

Vehicle for peace

China has touted the BRI as a vehicle for peace, stability, and prosperity. It says the BRI’s goal is one of economic integration, and that it will herald a new era of global prosperity.

Some critics, however, remain wary. There are claims that the plan is pushing “21st-century colonialism.”

Officials from the US, Japan and India have linked the BRI to China’s military ambitions. Beijing has strongly denied these claims.

BRI in Southeast Asia

Southeast Asia is viewed as a critical part of the BRI. In fact, seven of the largest BRI projects in Asia are located in Malaysia, Thailand, Myanmar, Indonesia, and Laos.

Indeed, Cambodia welcomed the initiative warmly. It has been seen as a pivotal way to overcome infrastructure gaps.

It is estimated that Southeast Asian nations will need to shell out a combined $2.8 trillion over the next decade to maintain their rapid growth. So, help from China can certainly help temper these costs.

At the same time, however, there have been voices saying the plan is a debt trap.

Default in Sri Lanka

Around 70% of those questioned in a recent survey by Iseas-Yusof Ishak Institute, a think tank connected to the Singaporean government, urged their governments to be cautious over the BRI.

The poll involved 1,008 Southeast Asian respondents from the government, academia, business, media, and several other sectors across all 10 Asean states. Some claimed the BRI was a ‘Trojan horse’ meant to expand China’s sphere of influence. Suspicions were highest in the Philippines, Thailand and Malaysia.

Many detractors of the deal have pointed to what happened in Sri Lanka in late 2017. The country was forced to hand over control of the Hambantota port to China after it was unable to pay a $1.3 billion debt on the project.

Roadblocks in Malaysia and Myanmar

The BRI has hit a rocky road in both Malaysia and Myanmar.

Shortly after taking office in August of 2018, Malaysian Prime Minister Mahathir Mohamad deferred or halted China-backed projects that were worth $22 billion.

The projects, signed during the administration of former leader Najib Razak, included the $20 billion East Coast Rail Link (ECRL) and two natural gas pipeline projects in Sabah worth $2.3 billion. Mahathir administration said the three projects were overpriced.

“We don’t need [the projects] at this time and the debt accumulated from them could bankrupt Malaysia,” Mahathir explained.

Pushback has also occurred in Myanmar. The government there ended up renegotiating a deal for a deep sea port in Kyaukpyu. Costs went from $7.2 billion down to $1.3 billion.

Thailand and Indonesia wary

Reaction to the BRI was initially frosty in Thailand. They went as far as rejecting Chinese infrastructure investment three years ago. However, they flipped their stance and agreed to partner with China on a railway connecting Thailand, Laos and China. The project, worth $14.2 billion, broke ground in late 2017 but has been delayed by numerous disagreements.

Several high-ranking Thai officials have since called for a reassessment of BRI projects.

In Indonesia, the BRI has also come under scrutiny. The country is facing a $1.5 trillion infrastructure gap. Since becoming president in 2014, Joko Widodo has aggressively courted China to help bolster infrastructure.

A slew of project deals was signed. Construction of a 150-km railway connecting Jakarta to Bandung, however, has garnered criticism. At $4.5 billion, many say it’s too costly and not necessary.

The country heads to the polls in April of this year.

Upbeat on BRI in Cambodia

Cambodia, as well, suffers from something of an infrastructure gap. Indeed the foreign investment from China has been welcomed to ease the gap. Other nations such as Japan and Korea have contributed on that front as well.

China has become Cambodia’s biggest foreign investor, pouring in more than $1 billion every year since 2013.

Under the BRI, China is funding the construction of the $2 billion Phnom Penh-Sihanoukville expressway and the $3.8 billion Dara Sakor project in Koh Kong province, which includes an airport, seaport, and a high-end resort.

Given that these projects are still relatively small, there isn’t much risk over defaulting. Many inside the country have said that more lasting effects will come from the private sector, where investors will benefit from boosted infrastructure.

Success in Vietnam, Laos, and the Philippines

Next door in Vietnam, BRI has also seen success. A BRI-centred deal was signed during President Xi’s visit to Vietnam in November of 2017.

China’s ambassador to Vietnam, Xiong Bo, who previously served as China’s top envoy in Cambodia, said during a BRI forum last November that China is willing to expand cooperation with Vietnam under the framework of the initiative.

In Laos, the 414-km China-Laos railway project is proceeding on schedule. The $6 billion is the centrepiece of BRI in the region. It involves the construction of 167 bridges and the digging of 53 tunnels. The railway promises to make Laos a fully-connected country.

Over in the Philippines, BRI projects have also been lauded. The pro-China administration of Rodrigo Duterte signed a deal in November to fund a sweeping $152 billion infrastructure overhaul. Projects include multiple railways and a dam.

Future of BRI in the region

While it’s true that the project has gotten mixed reviews across the board. Less developed nations like Cambodia and Laos are eager for the assistance. Indeed, as the project evolves, China will be better at adapting to feedback. Its partnerships across Southeast Asia are no doubt strengthening.

Most of the worries surrounding BRI are centred on larger projects. In Cambodia, however, most of the action is based on road work and port equipment.

Indeed, China-backed road work is nothing new in Cambodia. By the last count, around 70% of byways in the Kingdom have been built with at least some assistance from China.

The general consensus about BRI is quite positive in the Kingdom. There’s no doubt that boosting trade and stronger relationships with China can only serve to benefit investment activity in Cambodia.

For a more thorough look at the investment climate in Cambodia, head over to look at out Investment Guide 2019. It covers topics on everything from real estate to manufacturing to agriculture.

Check our listings for investment property for sale in Phnom Penh and investment property in Sihanoukville.

Comments