Proptech is an increasingly popular buzzword and encompasses disruptive and innovative technology in the property sector - we look at some of the trends in proptech being utilised in the Kingdom of Cambodia and how its technology has the potential to change the real estate industry.

What is proptech?

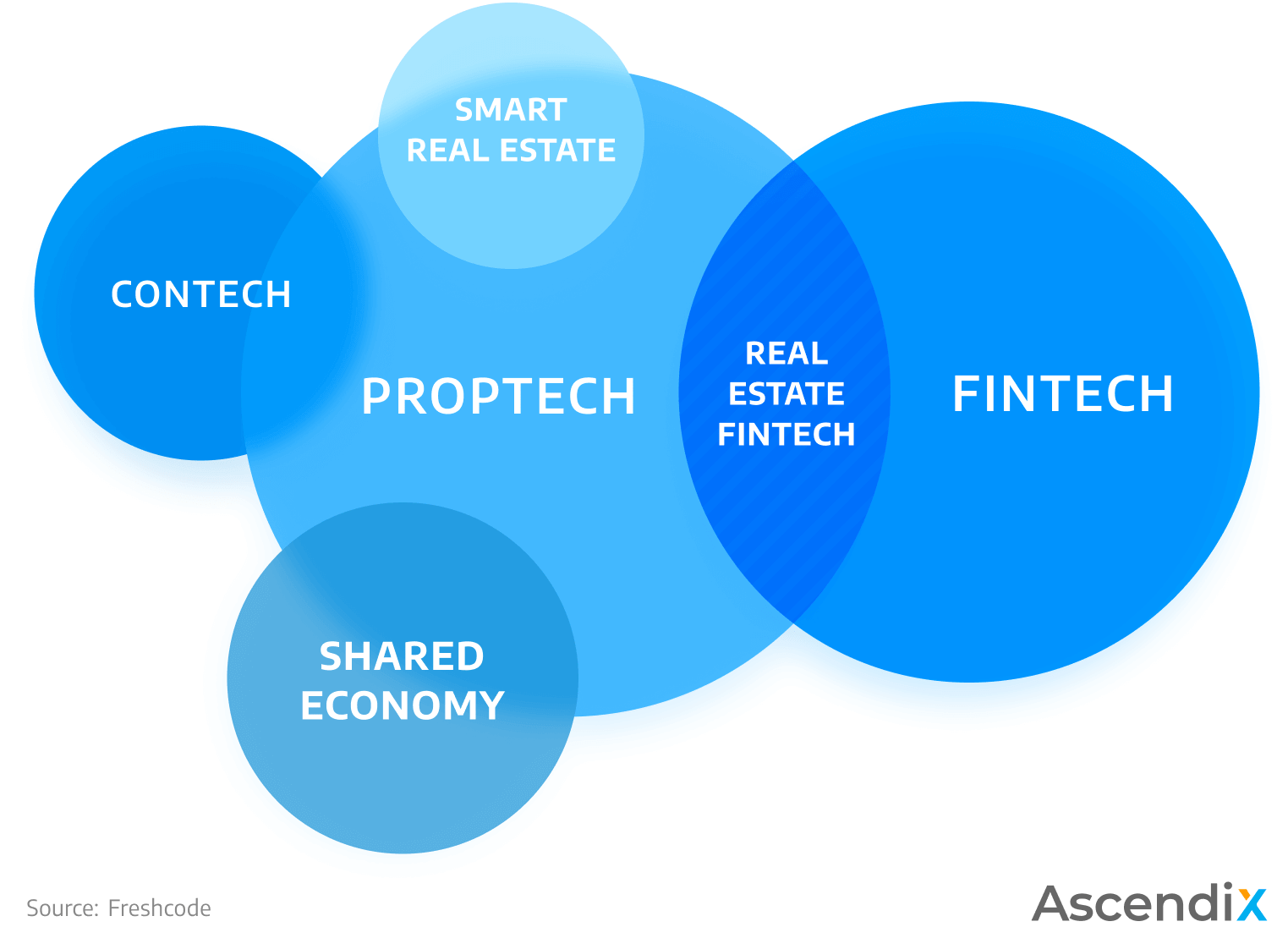

Proptech (property technology) are the tech tools the real estate professionals and property development industry can use to radically change the way and optimise buying/selling, research, and marketing among others. Proptech is the alignment between real estate and technology.

There are countless proptech companies but very few are truly disruptive and bring added value to the industry. According to one report, over the past decade - more than 9000 proptech companies were formed globally! The Asian Proptech real estate industry only accounts for 3.5% of the global number and is dominated by Chinese firms.

Examples of proptech could be a digital platform that utilises tech to promote properties, examples of smart real estate {Internet of Things, Virtual Reality (VR) & Augmented Reality (AR)}, fintech solutions, tech infrastructure such as data centres, or even leading edge tech such as the metaverse.

Ascendix predicts that some of the proptech trends in the near future include:

- Proptech Big Data & digitalisation of property data assets

- AI and Machine Learning

- Virtual Reality for better online search & buying experiences

- Chatbots for better customer experience

Proptech in Cambodia - VR and Web Functionality

Residential and commercial property tech facilitates the way people buy and rent properties while Commercial Real Estate (CRE Proptech) makes the use of innovative tools to efficiently run, search, rent, and the property assets.

Realestate.com.kh offers an innovative web (and app) platform which has more than 30,000 live property listings (commercial and residential) and 200,000 visitors monthly.

The company saw increased online traffic from international buyers in 2022 while the impact of the pandemic was still being felt. “Our online traffic really spiked during the pandemic as many investors were not able to fly to Cambodia,” said Tom O’Sullivan, CEO of Realestate.com.kh.

Property search platforms (which feature user-friendly listing and marketplaces, agent tools, etc.) are a great example of proptech. The Cambodian property market is changing (as well as property buyers in the Kingdom). “As the market returns to normality we have seen another spike in traffic both locally and internationally…we have witnessed a huge shift from desktop to mobile over the last few years”, added O’Sullivan.

The company also created unique user experiences for western, Khmer and Chinese property seekers with the web and app platforms hard coded in all languages as opposed to using Google Translate.

Realestate.com.kh also entered into a strategic partnership with property technology company, KE Holdings Inc. (Beike) to use RealSee VR technology in Q1 2022.

O’Sullivan said of the partnership, “We have actually been using 360 VR tours for over 3 years. But since the exclusive partnership with Realsee we have been able to scale this. It was almost perfect timing during COVID to focus on VR''. The company has educated the market with the tech and changed buyer behaviour and the CEO said it remains very popular as the country moves out of COVID.

Data Centres and the Push for Digitisation/Big Data

Big Data is another tech buzzword and is crucial in the ongoing move towards digitalisation and analytics. Big Data is also being used in making informed data-driven strategic and development decisions in the property sector.

The Asian Development Bank (ADB) reported digital technology and big data are key to fast-tracking post-COVID-19 economic recovery in Southeast Asia (SEA).and recommends policy reforms to help capture the benefits of big data, including improving technical infrastructure, and ramping up training to create a skilled workforce to lead the digital transformation.

Dan Fagg, Sygna Commercial Director APAC, says there is globally increased demand for data centres due to increased digitisation and Cambodia could benefit.

“From a development point of view, we have seen no let-up in the volume of new projects around the APAC region, and there only seems to be more to come for the near future. As more developed markets get saturated (in terms of land space and competition), we are expecting more growth in new/emerging markets, especially in SEA.

This has been aided by the development in (data) infrastructure over the last few years by both foreign and local enterprises, but it places the region in a good position for development for the years to come – however, high energy prices and availability of power in these areas could stump the potential growth.”

The data centre services market was valued at $48.9 billion in 2020 and is speculated this will increase to $105.6 billion by 2026.

Dan added he thinks there is a demand and opportunities for more local development, and suggests “being first to market in a lot of these instances is key. That said, the investment amount is significant compared to other developments (such as commercial, residential, hospitality).”

He concludes “Data centres are the future for the foreseeable future, but I am sure as technology advances the market will have to move with it, and it's unknown how that might impact existing investments/facilities.”

Blockchain Opportunities in Cambodia

Blockchain provides a secure, decentralised way to record and transfer ownership of assets.

Veasna Meas, Chief Executive Officer at Naki Group Co Ltd says utilising blockchain is beneficial in Cambodian property development.

“I believe utilising blockchain in Cambodian property development will help to provide access to a larger pool of investors. Some of the benefits of tokenisation include accessibility, diversification, transparency, and liquidity. What that means is those who desire to participate in real estate investment in Cambodia, previously had concerns about the process, or simply just do not know how to enter the market, can now do so with ease.”

His company is behind local developments such as Silvertown and it is a real-world example of using the technology. “The benefits of tokenising Silvertown specifically are 1) It’s a real-world asset and 2) It has been operating since 2014.”

He adds, “The fact that it has been operating for several years means we have historical performance data. With that, buyers of the Silvertown token can analyse past and estimated future performance to determine their returns. By having all the information for the project on the blockchain, it can help developers gain more liquidity by having access to more investors while investors have access to verified information.”

Naki Group has announced the upcoming launch of the first tokenised real estate investment offering in Cambodia. The Silvertown Token (STM) is being offered to investors starting Q4 2022.

Comments