Price Waterhouse Cooper (PWC) and Urban Land Institute (ULI) have authored a report describing key Asia Pacific real estate trends witnessed during 2023 and projected the likely course of real estate for 2024.

Localising the findings and applying local market characteristics, realestate.com.kh has provided additional commentary, insight and analysis.

Key Findings - Asia Pacific Real Estate Trends

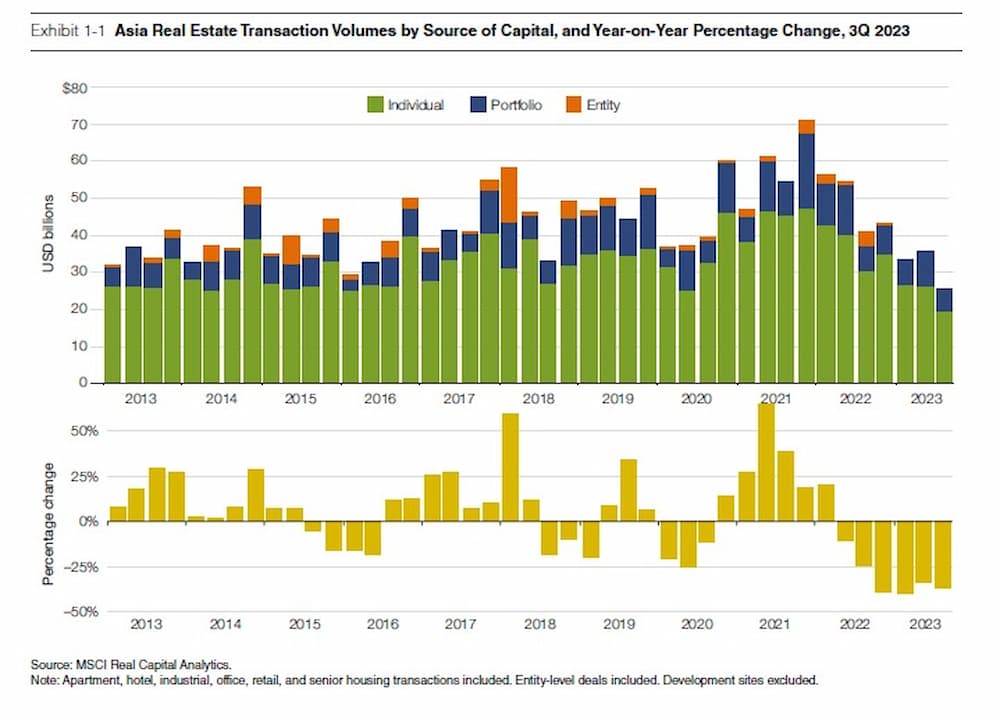

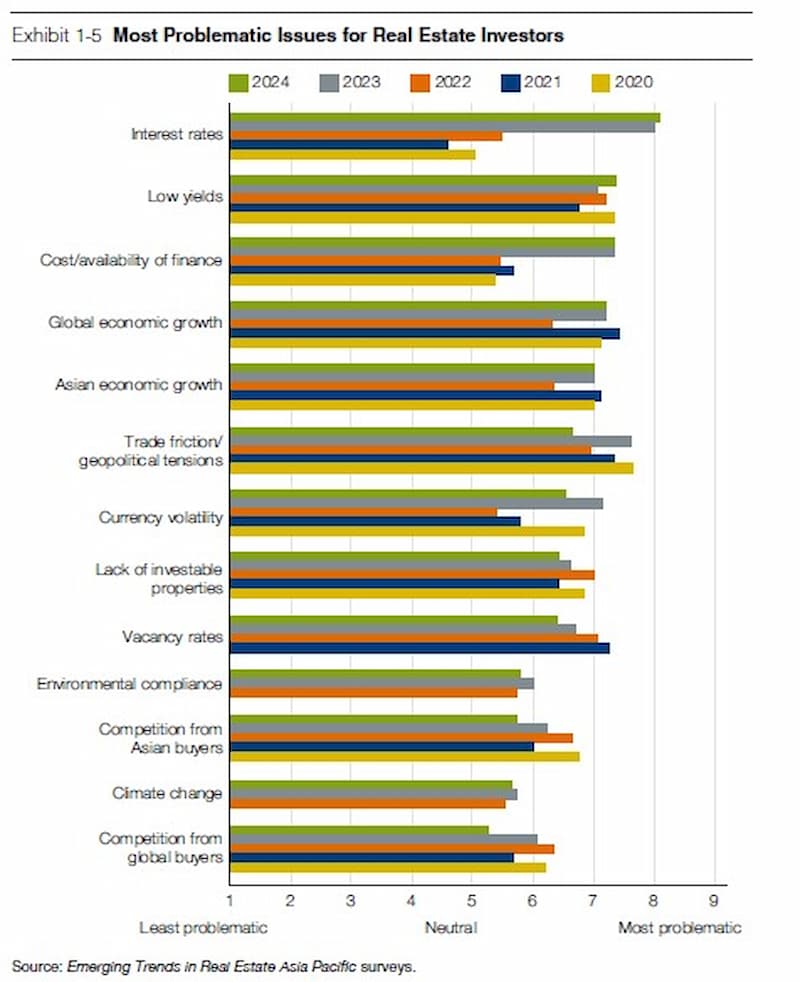

A key finding of the report was the impact of interest rate hikes on commercial real estate in the region. As a result of the myriad of knock-on effects on businesses, commercial real estate transactions are declining with traditional sectors such as commercial office buildings being out of favour with developers who are pivoting capital to alternatives.

Overall, the outlook is more optimistic for a recovery once markets stabilise from the early years post-pandemic. The IMF expects Cambodia to be the fastest-growing economy in Southeast Asia in 2024, with inflation contained at 3 per cent in both 2023 and 2024.

How Rising Interest Rates Have Disrupted Asia Pacific Real Estate

Central banks across the globe initiated unprecedented interest rate hikes in 2022, marking an end to over a decade of ultra-low rates. These changes in the cost of capital are having wide-ranging impacts on real estate markets across Asia and the globe generally.

In mid-2023, National Bank of Cambodia (NBC) Governor Chea Serey hinted at some risks, saying, “Falling credit growth and higher borrowing costs brought on by heightened interest rates across the globe may diminish domestic investment…”

- The average loan interest rates in Cambodia were up by 14 per cent (riel) and 11.66 per cent (USD) between January and June 2023.

- Fixed-term loan interest rates during 2023 ranged on average from between 7.5% to 10%.

In October 2023, the World Bank also heeded caution, calling for continuous monitoring for signs of overheating in the real estate credit market in Cambodia.

In response to these higher rates, banks have tightened both commercial and development lending. Along with the current market conditions, this is having the effect of reducing the number of new development projects which are likely to continue at least into H1, 2024.

A reduction in the pipeline of new supply combined with a rapidly growing economy in Cambodia will mean the excess supply in the market begins to be absorbed in 2024, and further into 2025, which will help correct the current supply vs demand imbalance.

In respect of Cambodia’s rapidly growing economy, there remains an overall positive outlook for the economy, with estimates unanimously above 5 per cent GDP growth from the leading financial institutions for 2023, and above 6 per cent for 2024 and beyond.

Locally, there has been a noticeable slowdown in the pace of land sales in 2023. The key reasons include large investors (domestic and international) holding back, in addition to the financial institutions reducing lending with tightening financing conditions. These cooling effects will help to restrain and reset land prices after speculation within the land market began to drive and rapidly increase prices in the Kingdom between 2016 - 2019.

Currently, the Ministry of Land Management, Urban Planning and Construction (MLMUPC) confirmed licenses have been granted to 2,600 construction projects with total investments of just under USD $5 billion in the first three quarters of 2023. A further positive was that early indicators of construction investment might even be heating over the course of Q4 2023.

Traditional Investment Strategies Not As Effective

Office and retail assets that previously dominated property investment strategies are now out of favour, suggested the trends report. This is because fundamentals such as high vacancies and structural concerns around long-term demand have deterred investors.

In the Asia-Pacific region, the traditional asset classes of office and retail are seen as less sought after by investors. One example was that office deals decreased by as much as 50% year-on-year in the first three quarters of 2023.

In Cambodia, the oversupply situation within the retail and office sectors has been widely reported.

- Occupancy rates in commercial office buildings within Phnom Penh are thought to have dropped from 85% to 60%, and for modern retail developments, from 70% to circa 63%.

- The increased adoption of technology across work-from-home for office and online shopping, and delivery services in the retail sector, have also contributed to weakened demand.

Outlook Remains Cautiously Optimistic For Real Estate

The report suggested that the real estate market's reset process remains incomplete but recovery is expected once new norms stabilise.

Emerging countries like Cambodia could benefit as the trend for foreign investors to diversify manufacturing bases away from China has accelerated. The real estate sector in the Kingdom has seen growth in Trust investments, and the key property announcements from Cambodia’s G-PSF 2023 showed that the government is trying to put in measures to help protect the sector and reassure investors.

The recently published FDI Standouts Watchlist also ranked Cambodia as having the strongest investment momentum into 2024 using data of nations which are entering the new year with a strong macroeconomic and FDI momentum.

The combined incentives such as government support for foreign investment, a young and available workforce and investment into the supply chain infrastructure, all bode well for the medium to long -term. Ultimately, Cambodia is still viewed as an attractive target for foreign and local developers, as well as investors.

Comments