There seems to be uncertainty in the air about property investments in Cambodia, despite the forward-looking data and overall sentiment from visiting investment groups which have been overwhelmingly positive.

One of the legendary investment pioneers Warren Buffett's most famous quotes is “Be greedy when others are being fearful'' and eagle-eyed buyers have been snapping up Cambodian properties at good prices. This all depends on your strategy and goals but for some time we have suggested it is a cash-rich buyers' market in the Kingdom with market prices a better reflection of the value and new developments appropriately adjusting to the market and demands.

Owning and Renting Property in Cambodia As A Foreigner

Cambodia introduced the Strata Title Law in 2010 and this enabled foreigners to own condos above the ground floor. The policy was aimed to attract foreign investment and stimulate economic growth- there are also no specific legal restrictions on foreigners renting apartments in Cambodia.

Despite rates of urbanisation in the Kingdom among ASEAN nations remaining very strong, renting (or buying) an apartment is a relatively straightforward process, and it's easy for expatriates to easily find suitable options depending on their budget across Cambodia, particularly in the urban areas.

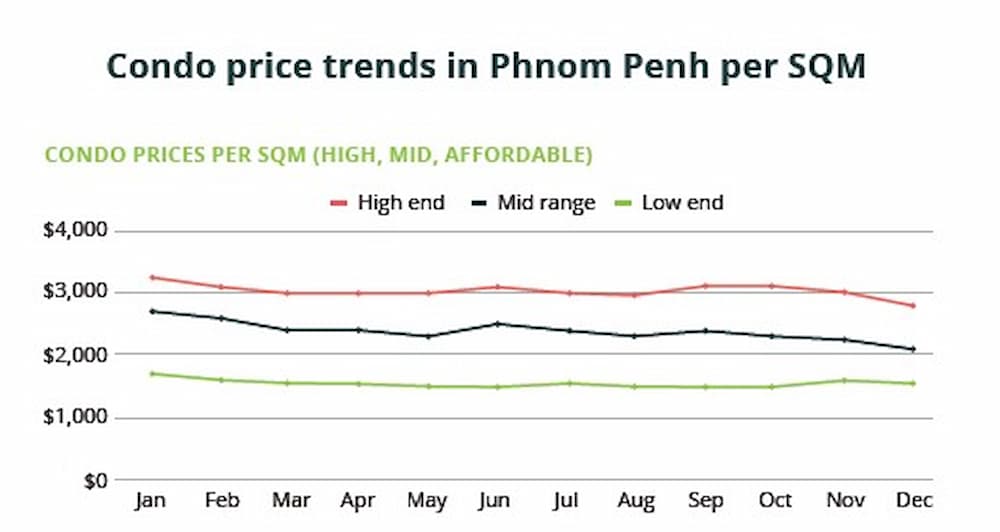

Average asking prices for high-end condominiums in the capital were USD $2,609 per meter according to a CBRE Q1 2023 report. These have dropped off but property and condo investments are meant to be long-term holds and investors and buyers who hold on to their units will likely see future gains. The vision needs to be long-term and not panicked by ebbs and flows in any market.

A recent report released by Realestate.com.kh highlights a substantial adjustment in the pricing of off-plan condominiums that occurred when contrasting 2019 prices with those in 2023. The report indicated the average price per square meter for off-plan condominiums in the capital has decreased from USD $2,800 to $2,000 / sq.m.

We have addressed the market price corrections previously and this has led to off-plan condominium sales and robust sales rates for new condominium project launches in Phnom Penh, especially for well-developed new launches from developers who have established and proven track records.

Buyers of property (both foreign and Cambodian) are better informed in their decision-making and there is more regular, and hopefully, reliable reporting on the markets. The current property market sees homeowners looking for quick sales - and the market still is advantageous for cashed-up buyers to secure purchases at favourable prices.

According to the Semi-Annual Report 2023 from the National Bank of Cambodia (NBC), the total amount of loans released by banks in Cambodia increased to 11.9 per cent (USD $45.8 billion) in the first half of 2023. Housing loans increased 17.5 per cent (worth approximately USD $6.64 billion) compared to 2022 as the real estate sector grows in 2023. The NBC report indicated that housing loans by banks was the sector with the second fastest growth.

While the sale of twin and single villa residential projects has declined, the Residential Property Price Index (RPPI) showed that the prices have not remarkably changed in 2023.

Finally, the report added that the sales of condominiums in Cambodia have positively increased 12.9 per cent in the first half of 2023 compared to the same period in 2022 - while the number of construction projects has fallen approximately 10 per cent from 2,000 to 1,800.

There were still ten completed condo projects and 3 new launches in the first half of 2023 in Phnom Penh which saw 1600+ condo units enter the market with 8,000 expected in total by the end of the year.

Realestate.com.kh CEO Tom O’Sullivan said recently there was a spate of ‘revenge spending’ post-pandemic as some buyers thought it would be the last time to buy property at affordable prices before it bounced back stronger but this hasn't necessarily been the case in 2023 - also due to global economic headwinds. O’Sullivan said that the prices have stabilised in the Cambodian property sector to be more realistic and re-iterated that new developments that have launched in 2023 have offered lower and more realistic margins and are coming online at a great price.

“Whether it's on our platform or those expressing an interest (with healthy down-payments or cashed-up investors) buyers are ready to take up the opportunities in the Cambodian property market,” added the CEO.

Investor Groups Remain Optimistic

The global market conditions, the unease of how China has recovered in 2023, and the increased interest rates have all been headwinds for the local sector but these should be short-term.

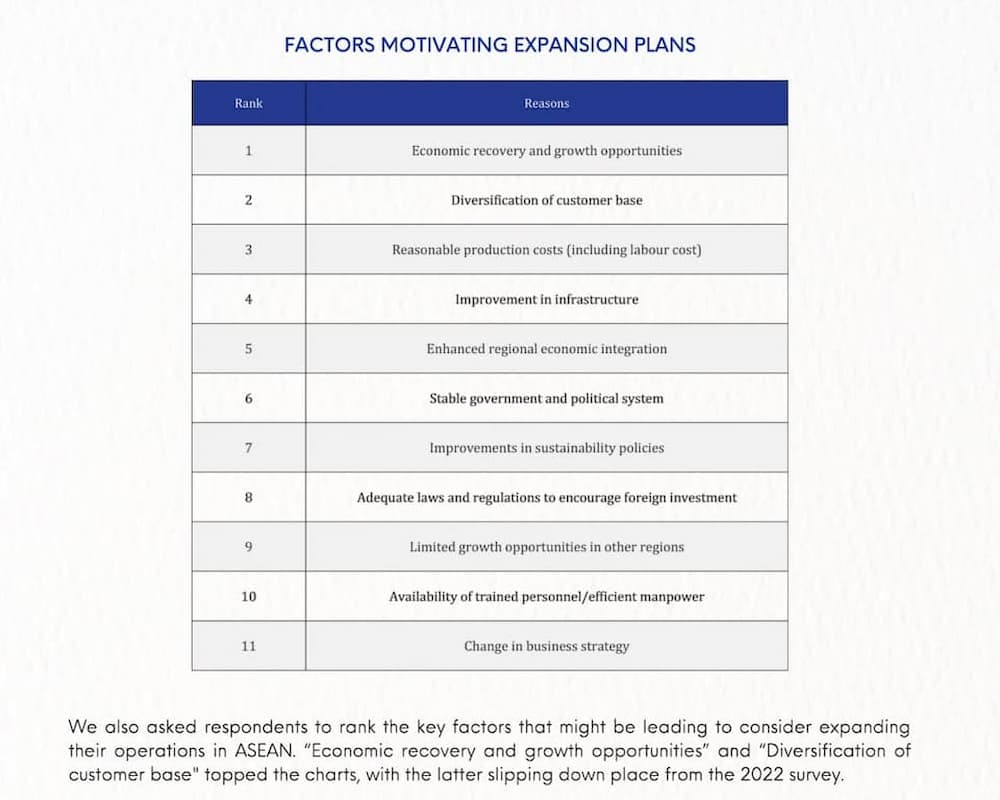

The recently released survey on EU business sentiments in the region is very favourable, while there have been on-the-ground investor visits from Singapore, Thailand, and China in 2023 who have been impressed by the scope of general business opportunities.

The EU-ASEAN Business Council views ASEAN as offering the best economic opportunities over the next five years and some of the regional positives are all reflected in the appeal of Cambodia; macroeconomic conditions, the policy and regulatory environment, and the development of bilateral and plurilateral free trade agreements in the region.

The investor sentiment was reflected in the fact that European businesses expressed a positive outlook on looking to expand their operations in ASEAN.

The Cambodia Consumer Report 2023 (produced by Standard Insights and Cambodian-based consulting firm Confluences) provided an overall positive outlook towards economic growth too among Cambodian consumers - 91.83% are hopeful about their future.

Why Cambodia Remains Investment Friendly

There have also been a glut of investment reports released on Cambodia in 2023 and the same recurring themes remain the same and the same attractions ring true for the years to come.

Realestate.com.kh Why Cambodia Guide, the DFAT Handbook on Investing in Cambodia, a collaborative endeavour between Cambodia and Australia, as well as the Profitence Cambodia Country Profile all sing to the same tune, Cambodia offers numerous advantages to investors:

- Solid economic growth

- Strategic geographical location

- Favourable investment climate for foreigners

- Growing infrastructure development

- Supportive legal framework and social and political stability.

The country has been one of the fastest-growing economies in the region and GDP for 2023-2025 remains very strong even among frontier markets and especially in Asia. Cambodia has managed to successfully attract foreign direct investment, and the economic reforms are favourable to foreign investors while also optimistic for significant economic growth.

The Cambodian market is actually very open to foreign investment, with 100 per cent foreign-owned investment permitted in almost every sector and foreign ownership of property in some cases also allowed, the expanded Trust laws are opening this up even further.

Finally, there has been an alignment with international investment frameworks and a real attempt by the National Assembly to work with investors From the Trust Law, Construction Law, Law on Public-Private Partnerships, Law on E-commerce, Law on Social Security Scheme, Law on Consumer Protection, Competition Law and the Law on Investment).

Finally, buyers and investors want stability. The scheduled swearing-in of the new Cambodian government reshuffle expected on August 22, 2023, should offer this continuity and stability as the nation will be led by a younger and foreign-attuned cabinet who are keen to implement and build on the progress made by the Kingdom over recent decades.

Comments