Simon Griffiths, the Head Of Real Estate at realestate.com.kh recently spoke at an organised event entitled “2024 Property Market - The Untold Story” which was held in the Cambodian capital in late February and provided an overview of the Cambodian condo market background.

With more than a decade of experience working in the real estate sector in the Kingdom, Griffiths joined realestate.com.kh in 2023 armed with a Master's Degree in Commercial Property Development and Management and had spent six years at CBRE as well as owning his own commercial real estate firm.

In his capacity as Head Of Real Estate, he has engaged in some deep dives through the data and researched the trends with a specific focus on the condo market. We lay out his findings of the Cambodian property cycles over the past decade and what lies ahead for the sector.

Understanding The Cambodian Condo Property Market Cycles

2009-2013

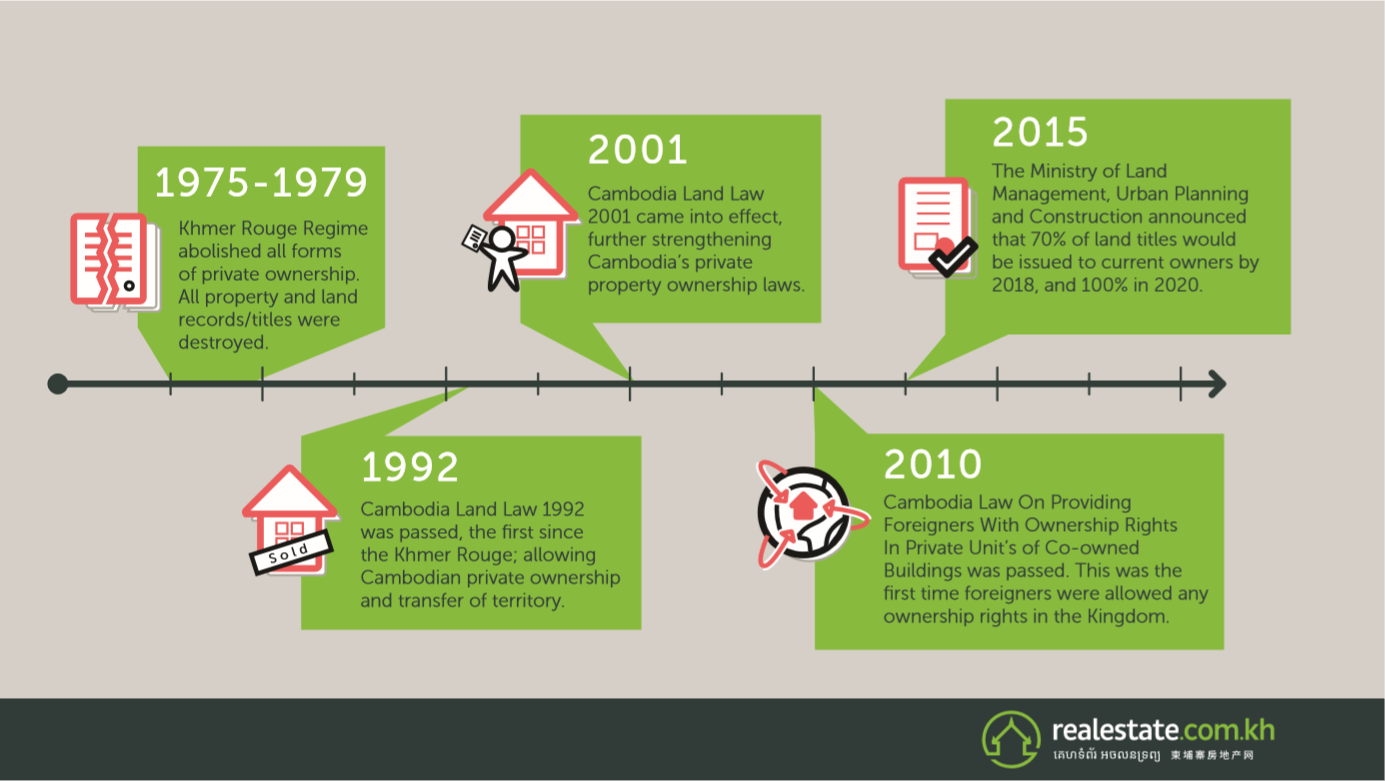

Griffiths explained that the Cambodian modern property cycle started around 2013 but the groundwork had been laid as early as 2009 when the sub-decree on co-owned buildings allowed for a hard title which was followed by the change of laws allowing for foreign ownership with certain restrictions.

However, the timing was concurrent with the global financial crises which placed extreme stress on global financial markets and banking systems between mid-2007 and 2009 - ultimately it placed firm brakes on the growth of the property market in the Kingdom. Griffiths added that there were some green sprouts which arose from this first crisis - two large concrete commercial properties were built in Phnom Penh - Canadia Tower and Phnom Penh Tower.

2013-2016

However, the condo market was halted and there was a slow recovery from 2013-2016 in which around 5000 units or less entered the market in Cambodia.

In this period, 55 condominium projects were launched which helped build momentum - although it must be acknowledged this came from a low baseline, which resulted in high growth.

2017-2018

From around 2017-2018 onwards, the Cambodian condo market saw a distinct acceleration and a more modern condominium sector developed, which Griffiths separates from the period of 2013 to 2016.

The market also saw distinct growth of interest and buyers from Asia - including South Korea, Japan, Singapore, Malaysia, and Taiwan.

2017-2020

Between 2017-2020, the Chinese market became very dominant in Cambodia - this included both Chinese developments and Chinese buyers.

As the market evolved and was driven by Asian-Pacific interests, what was happening in the real estate sector, Griffiths explained, was that for example, Singaporean developers would have their own Singaporean contacts from their own Singaporean network, and the same happened with the Japanese, Taiwanese, and other markets. That's how many from the region were introduced to the condominium market in Cambodia.

This buyer pool and the amount of demand being generated via international developers started to increase, argued Griffiths, and as a result, prices started to rise from a moderate base and steadily increased.

Since 2013, condo prices in the Kingdom steadily increased for five years annually between 10-25 per cent and then the addition of high-end positioning of condominium projects launched into the market, diversifying what were largely mid-market products.

As multiple tiers were established, buyers could choose from a selection of more affordable condominiums in Cambodia’ including mid-range condominiums and high-end.

COVID-19 Placed Brakes On The Cambodian (and Global) Property Market

Prices in Cambodia for the first time reached a peak of over USD $4,000 per square meter pre-pandemic, but then COVID-19 once again caused global brakes on all growth and interactions. The period was one of uncertainty and has bled into the current period of “painful adjustment” said Griffiths.

New products and new condominiums still enter the Cambodian market and the situation has changed slowly and without a sudden jolt.

Some market conditions have not materialised as some expected;

- The Chinese buyers and investments didn't come back as anticipated.

- Developers who launched condominium developments pre-COVID in Cambodia, with pre-COVID pricing and demand, found themselves priced out of the market.

- New developments have entered and been able to adjust to a new reality and market conditions.

The compound result has been a slowly increasing amount of condo supply since 2020, while demand has heavily been reduced - this has combined to drive rental prices down.

Some newer developments which have launched in Phnom Penh over the past year are actually back at below 2013 prices. The market also now has more mature developers and those with a proven and successful track record of developing projects.

2024 And Beyond - What To Expect Of The Cambodian Condo Market

When looking at the current situation in 2024 and where to now, Griffiths said, “In my opinion, we've reached the bottom and we will start a property cycle where new project launches will offer greater value in terms of pricing, but also in terms of delivery for what they're able to offer to their buyers. New project prices are undercutting the market. And this is positive.”

There are some global property patterns which are replicated he said - there are periods of growth and then a pattern of recession. Growth generally has an upward trend, especially in developing/emerging nations but this tends to be more dramatic or undergo a faster increase explained Griffiths.

There are things that can be controlled, and barring any exceptional circumstances or global shocks, he anticipates a steady increase in property prices in the Kingdom.

“We've been through the pain. Yes, there might be six months more to wait, but we're starting to see the early shoots as the US Federal Reserve weighs its rate-cutting decisions, and inflation looks to be under control - the anticipated cut in interest rates in 2024 will provide a positive sentiment in the market that will trickle down to Cambodia.”

No one has a crystal ball to look into the future and as Griffiths quipped “What will the property cycle look like? If I knew exactly, I wouldn't be here talking to you. I'd be a millionaire on a yacht.”

However, an analysis of the data and trends suggests there is good reason to think that property prices won't stay as low as they are, which means the only way is up in his opinion.

Other factors to consider for the Cambodian condo and real estate market in the short-medium term are:

- The Cambodian regulatory environment means the market could see a productive development phase.

- More diverse financial products on the market, in terms of favourable payment terms, mortgages and loans are positive signs.

Ultimately the lessons learned mean there is a more mature environment in the Kingdom - both developers and buyers. An increased number of developers with experience and who have proven that they can develop real estate products with their buyers achieving high rental yields, as well as capital gains are positive for the property condo market in the long-term.

Comments