The Cambodia 2023 Business Confidence Survey was released at the recently held ASEAN-Cambodia Business Summit in Phnom Penh in September 2023. This comes at a time when several high-profile business events have focussed on the changing economic climate, and future-looking strategies.

Despite ongoing global challenges, unanimous predictions from the leading financial bodies predict Cambodia is poised for good economic growth in 2023 and 2024 - so what is the investment and business sentiment for the Kingdom?

Cambodia 2023 Business Confidence Survey - Positive Outlook

Based on the results in the survey, more than two-thirds of businesses consider Cambodia to be competitively average compared to other ASEAN countries but 9 per cent feel that Cambodia’s competitiveness is still strong as was the sentiment in the 2023 survey.

The ease of doing business is key to attracting investment and the latest data for January-September 2023 doesn't suggest this is waning. Cambodia attracted USD $3.76 billion of fixed-asset investment from January-September 2023 - an increase of 8.6 per cent compared to the same period in 2022.

Leading financial institutions have updated their economic outlooks for the Kingdom:

- The ASEAN+3 Regional Economic Outlook (AREO) projects Cambodia’s economic growth for 2023 at 5.9 per cent with forecasts for 2024 at 6.7 per cent.

- The International Monetary Fund (IMF) outlook for Cambodia, updated on October 10th 2023, suggests 5.6 per cent growth in 2023, and 6.1 per cent in 2024.

- The Asian Development Bank (ADB) adjusted its forecast for Cambodia’s economic growth in 2023 to 5.3 per cent, slightly down from its prior 5.5 per cent projection.

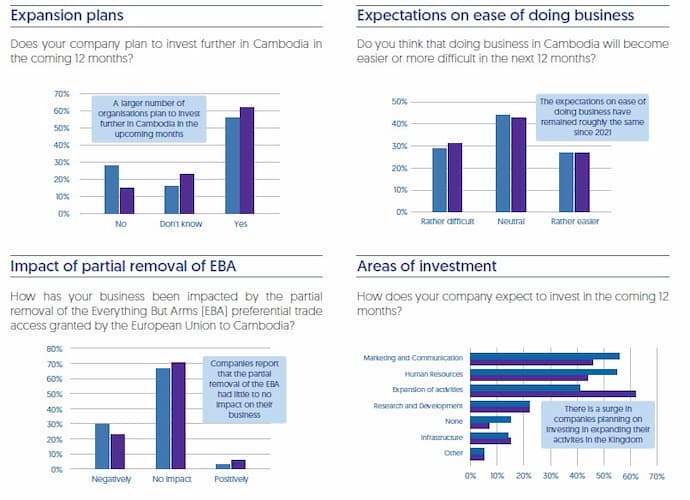

Among the businesses that participated in the EuroCham survey, there is also positivity about the future. More than 60 per cent plan to invest further in the Kingdom in the next 12 months.

Businesses are also seeing profitability increasing post-pandemic, with as many as three-quarters having met or exceeded their annual profitability goals. A third of respondents even expressed that they had exceeded their profitability targets in 2023.

It should be noted that a number of investment guides for Cambodia have been released in 2023 by various business chambers and sectors, which all offer a good overview of the potential of the market but sensibly also offer caution and advice.

The advice includes that any investor should first visit the country (possibly multiple times), assess and study the market, and be familiar with the local conditions and business culture - all of which can be applied to property investment in Cambodia too.

ASEAN-Cambodia Business Summit 2023

The recently held ASEAN-Cambodia Business Summit in Phnom Penh featured several key addresses from local and regional business and government leaders.

H.E. Dr. Aun Pornmoniroth, Cambodian Deputy Prime Minister and Minister of Economy and Finance highlighted what he perceived to be the main actions the government has undertaken to improve the local business environment.

- The Pentagonal Strategy – Phase 1 outlines the intention to focus on implementing institutional reform and introducing new measures to address current issues that businesses and investors face in Cambodia.

- Improvement of market access and integration to regional and global supply chains has resulted in increasing multilateral and bilateral free trade agreements (FTAs) - there is no slowdown in chasing new agreements which will help diversify trading partners.

- Acknowledging the impact of the private sector and its role in improving the Kingdom’s prosperity, the government wants to streamline administrative procedures, reduce transportation and logistics costs, promote vocational and skills training, and introduce further investment laws to incentivise investors in Cambodia.

- Connectivity is crucial - this applies to infrastructure such as new bridges, deep water ports, new airports, road extensions, etc. as well as digital connectivity. New digital business processes and payment systems, as laid out in the Digital Economy and Society Policy Framework 2021-2035, are intended to encourage investments in Cambodia’s digital economy.

Dr. Pornmoniroth wants to see continued increased dialogue between the public and private sectors so that strategies can target the challenges businesses face in Cambodia. Certainly, the right signals are being broadcast that there is every intention to maintain the view that Cambodia is investor-friendly.

Shifting Models And Mindsets In Cambodia

We have addressed several times the shifts the Cambodian property and construction industry has had to make to adjust to the post-pandemic realities and these include realistic pricing as well as ensuring quality developments, well-managed marketing campaigns, and appreciating the buying portfolio has changed.

The same shifting paradigms are being applied to all businesses in the Kingdom. Dr. Stefan Hanselmann, Cluster Coordinator for Economic Development and Private Sector Promotion at GIZ, said at the ‘Investment Promotion Conference 2023’, that “Cambodia is in need of a new business model because the model guaranteeing economic growth over the past 25 years has now come to an end.”

He made the point that the previous business model of relying on low-tech industries with low-skilled labour at very low costs could no longer persist - and with the government-led goals of leaving the LDC status over the coming years, this is true.

Attracting foreign direct investment is crucial across all sectors but the combination of positive economic data and business sentiment suggests that the Cambodian government and other institutions will continue to demonstrate an astute level of awareness about attracting and managing FDI while remaining honest and committed to listening to the concerns raised by the private sector.

Comments