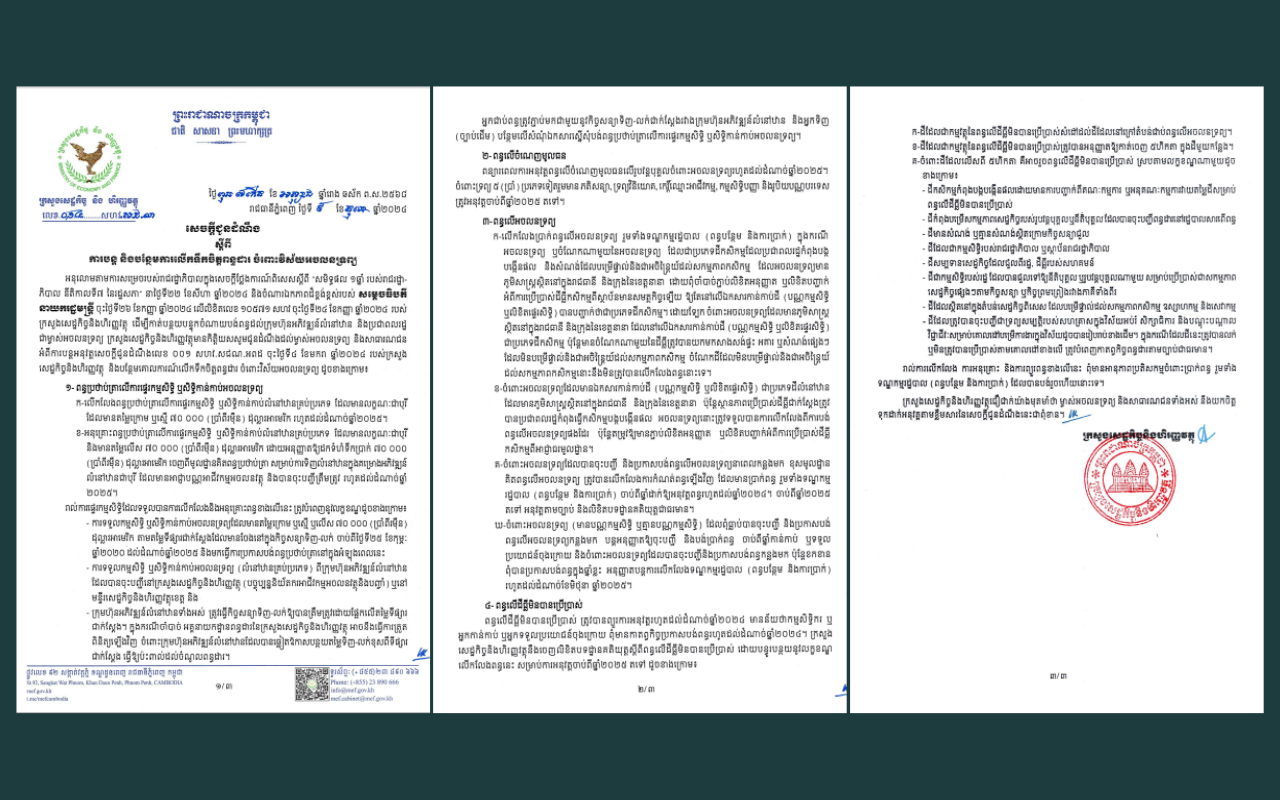

The Ministry of Economy and Finance has released an official notification detailing a series of tax exemptions, additional relief measures, and suspensions designed to support Cambodia’s real estate sector. These initiatives are aimed at easing financial pressures on property owners, investors, and developers while promoting continued growth and investment in the country’s property market. The notification covers key areas of taxation relevant to the real estate industry:

I. Stamp Duty Tax

- Continued Exemption: The stamp duty tax on the transfer of ownership or possessory rights for housing within Borey projects, valued at or below $70,000, will remain exempt until the end of 2025. This measure is intended to make homeownership more accessible to Cambodians by reducing the tax burden on affordable housing.

- Additional Relief: For housing within Borey developments that exceed $70,000 in value, an additional relief measure allows buyers to deduct $70,000 from the taxable base before the stamp duty tax is applied. This relief will also continue until the end of 2025, incentivizing investment in mid- to high-range properties within properly registered housing projects.

II. Capital Gains Tax

The implementation of the capital gains tax on specific types of income, including lease agreements, investment assets, intellectual property, goodwill, and foreign currency, has been further delayed until the end of 2025. This suspension is part of the government's effort to provide a more favorable investment environment and ease the tax burden for property investors and business owners. Learn more about the overview of Cambodian Real Estate Updates in 2024.

III. Immovable Property Tax

- Agricultural Land Exemption: Immovable property tax will continue to be exempt for agricultural land that is actively used for cultivation in cities and provincial capitals. This exemption applies even without formal certificates from authorities, as long as the land title specifies agricultural use. However, properties with land used for non-agricultural purposes, such as housing or commercial construction, will not qualify for this exemption.

- Exemptions for Residential Land: For land that is registered as residential but is currently being used for agricultural purposes, property owners can also apply for a tax exemption, provided they obtain certification from the local authority. The tax exemption will apply retroactively for land that has been cultivated without proper registration in the past, with administrative penalties waived until June 2025.

- Past Property Tax Exemptions: Property owners who previously registered their properties and paid property tax are eligible for continued exemption from re-taxation, including administrative penalties, until the end of 2024.

IV. Unused Land Tax

The Ministry has suspended the unused land tax until the end of 2024, offering relief to landowners. From 2025, new conditions for tax exemptions will apply, with land outside taxable areas or exceeding 5 hectares subject to the tax unless exempted. Exemptions include agricultural land, land used for economic purposes, leased land, and land used for education or vocational activities.

Properties must be properly registered, and sales must reflect actual market prices. The Ministry will enforce compliance, with penalties for underreporting. The notification clarifies that these exemptions and reliefs are not retroactive, meaning taxes already paid will not be refunded.

To Sum up

These comprehensive tax relief and exemption measures are intended to support Cambodia’s real estate sector, stimulate investment, and encourage property ownership. By extending exemptions and delaying the implementation of certain taxes, the government hopes to alleviate financial burdens on property owners and developers while encouraging continued growth in the market. The focus on affordable housing, agricultural land, and long-term investment will help stabilize the sector and promote sustainable development in Cambodia.

All stakeholders, from property developers to individual investors, are encouraged to take advantage of these measures while they remain in effect.

----------

Are you interested in buying property in Cambodia and want to know more about the law here? Contact our experts via:

📞+855 92 92 1000

📧 info@realestate.com.kh

Comments