What Are Green Investments?

Green investments refer to traditional investment options—such as stocks, exchange-traded funds (ETFs), mutual funds, or bonds—focused on supporting companies and projects that prioritize environmental sustainability. These investments target businesses actively working to reduce their ecological footprint by implementing practices like waste reduction, carbon emission control, resource conservation, and enhanced energy efficiency. Unlike conventional investments, which primarily seek financial gains, green investments aim to provide returns while contributing to the planet’s well-being.

In today’s world, where climate change and environmental challenges are pressing issues, green investments allow investors to align their financial goals with sustainable values, providing a unique way to build wealth while supporting eco-conscious enterprises.

Sustainability as a Core Value:

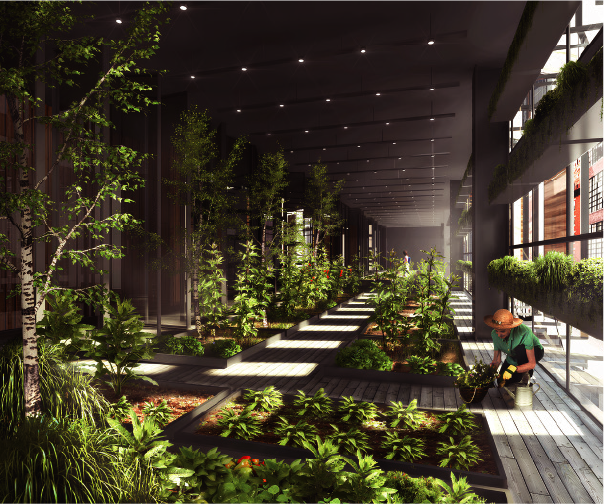

In the real estate industry, sustainability has become a fundamental value in green investments. As environmental awareness grows, developers, investors, and consumers are increasingly prioritizing eco-friendly practices. Green investments focus on creating energy-efficient buildings, using sustainable materials, and minimizing environmental impact. For example, Picasso Sky Gemme the design integrates sustainability and art to create a city garden in the heart of a bustling metropolis. This blend of eco-friendly practices with artistic beauty brings humanistic, green spaces to urban living.

By integrating renewable energy sources and reducing carbon footprints, sustainable real estate not only addresses urgent environmental concerns but also offers long-term financial benefits. This approach attracts environmentally conscious buyers and tenants, increases property value, and lowers operational costs, establishing sustainability as a central pillar in the future of real estate investments. '

Government Incentives and Regulations:

Governments worldwide support green building investments through tax incentives, subsidies, and regulations, making eco-friendly real estate financially appealing. These measures encourage developers and homeowners to prioritize sustainability, with mandatory energy standards ensuring compliance and quality.Investing in green real estate offers significant benefits.

Environmentally, it reduces emissions, supports biodiversity, and conserves resources. With incentives and innovations, green homes are more affordable, and energy-efficient designs cut utility costs, offering long-term savings. Green homes also hold a competitive market edge, are future-proofed against upcoming standards, and promote health by creating quality living spaces.

Consumer Demand Is Shaping the Market

Demand, or the desire of consumers to purchase a product or service, drives market activity by prompting businesses to adjust supply. In real estate, rising consumer demand, especially from environmentally-conscious Millennials and Gen Z, is fueling green investments. These generations seek homes and offices that reflect their values, prioritizing energy-efficient features like solar panels, smart thermostats, and low-flow water systems. Time Square 8 exemplifies this shift, balancing quality and affordability in Phnom Penh’s growing market with eco-friendly design elements that align with today’s sustainable lifestyle expectations. For developers, adding such sustainable elements is no longer a trend but an expectation.

Green Real Estate Investments Are the Future

The real estate sector’s significant contribution to carbon emissions and energy consumption makes sustainable practices essential. Green real estate investments allow eco-conscious investors to support sustainability while earning returns. As demand for low-impact properties grows, the green real estate market is expanding, becoming a valuable part of investment portfolios. By integrating environmental responsibility with profitability, green real estate investments contribute to a sustainable future and a healthier planet.

Conclusion: Long-Term Financial and Environmental Benefits

Green real estate investments are reshaping the industry by prioritizing sustainability in design and construction. As consumer demand for eco-friendly properties rises, alongside government incentives, developers are recognizing the financial advantages of going green. Energy-efficient buildings offer lower operational costs, higher property values, and stronger returns on investment. Moving forward, green investments will continue to lead the way in building a more sustainable, profitable, and environmentally responsible real estate market.

Comments