Introduction:

Introduction:

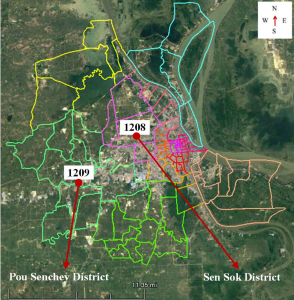

Covering the majority of the western part of the capital, Pou Senchey district (locally called ‘khan Pou Senchey’ or Khmer: ខណ្ឌ ពោសែនជ័យ) is currently the largest of all 12 districts of Phnom Penh and home to about 184,000 residents. As of today, Pou Senchey is administratively subdivided into 10 communes (locally called ‘sangkat’ or Khmer: សង្កាត់), namely Boeng Thum, Chaom Chau, Kakab, Kamboul, Kantaok, Ovlaok, Phleung Chheh Roteh, Samraong Kraom, Snao, and Trapeang Krasang.

It shares borders with four other districts, namely Preaek Phnov district to the north, Sen Sok and Meanchey to the east, and Dangkao to the south.

Market Summary:

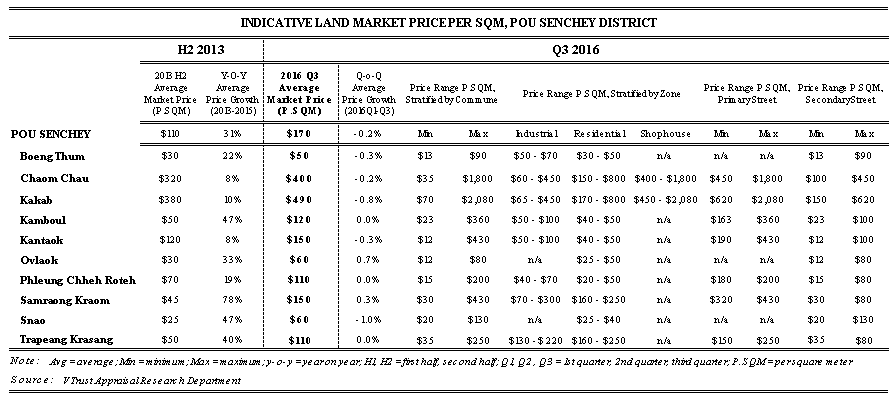

Pou Senchey, since the last decade, has seen a rapid pace of development, especially in the realm of residential, commercial, and industrial sub-sectors, leading to a considerable land price surge across the district. Observed within the period of the past three years, the district experienced an average annual growth of 31 percent in land prices, from US$110 p.sqm. in 2013, when averaged across the whole district, to US$170 p.sqm. in Q3 2016. Within those three years, 2014 and 2015 marked the strongest growth for land prices, yet during the course of three quarters of 2016 the prices were sluggish to move upward due to the situation that overall real estate market has cooled down steadily since late 2015.

sluggish to move upward due to the situation that overall real estate market has cooled down steadily since late 2015.

Fortunately, recent housing and plot land subdivision market stimuli practiced by many of developers have been seen to bolster the market growth again, albeit slowly, and this trend will continue helping boost market demand and thus keep real estate prices from going down negatively.

Land Market and Pricing:

In general, market prices for land across Pou Senchey district grew 31 percent y-o-y since 2013 until 2015, while the two bustling communes of Chaom Chau and Kakab grew about or less than 10 percent y-o-y because prices in the two communes were already high compared to the rest of Pou Senchey’s other communes.

In term of land values and major business hubs, however, Kakab and Chaom Chau stand out from the rest thanks to their strategic locations as well as coverage of prime streets ideal for business positions. Kakab commune is immediately adjacent to Tuek Thla of Sen Sok district, while Chaom Chau commune is westwards next to Kakab.

In Chaom Chau, land prices across the whole commune ranged from US$35 p.sqm. in undeveloped zones to a peak of US$1,800 p.sqm. along prime streets (e.g. Confederation de la Russie) and bustling commercial hubs. The average market price in Chaom Chau was US$400 p.sqm in Q3 2016, growing from US$320 p.sqm. in 2013. The average growth for land market prices was eight percent y-o-y.

Immediately adjacent to Phnom Penh International Airport, Chaom Chau covers some part of the capital’s arterial street, namely Confederation de la Russie (Russian Boulevard in English), National Highway 3, and National Highway 4. Further, it shares a long distance of Veng Sreng Blvd.

With similar geographic positioning, Kakab shares a similar market value as does Chaom Chau, but being closer to the central business hubs of the capital makes Kakab stand out in term of land prices and commercial demand. Land prices in Kakab commune grew 10 percent annually, from an average of US$380 p.sqm. in 2013 to US$490 p.sqm in Q3 2016. Kakab’s land market prices could range from a small base of US$70 p.sqm. in the undeveloped areas to a peak of US$2,080 p.sqm. along prime streets and in the most bustling commercial hubs.

Nevertheless, a notable land price growth was mostly witnessed in less developed communes, as speculation seemed to be challenged by high prices in prime hubs and along major streets, but this speculative vision rather spilt over across the underdeveloped suburbs of Pou Senchey. For example, less developed communes such as Samraong Kraom, Kaboul, Snao, and Trapeang Krasang experienced a land price surge of about and more than 40 percent y-o-y, mainly due to their small price base and high price jump, as driven by the trendy development of plot land subdivisions.

Samroang Kraom, which shares a long distance of Tomub Kop Srov Road, was seen with a remarkable growth in land prices following the road development that is currently almost complete. In 2013, the average market price of land in this commune was about US$45 p.sqm., and in Q3 2016 the average price reached US$150 p.sqm.. The average annual growth in the Samroang Kraom was almost 80 percent within the period of those three years.

Similarly, Kamboul, Snao, and Trapeang Krasang experienced a big jump in land price growth, mainly driven by (1) increasing plot land subdivision development, (2) increasing demand for low-price land parcels and housing in the peripheral suburbs of the capital, and (3) the rapid pace of urban expansion especially since early this decade.

Prime Street and Pricing:

Chaom Chau

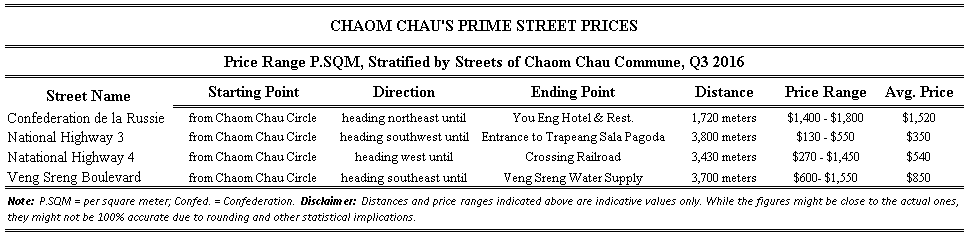

Chaom Chau is located west and south of Phnom Penh International Airport, being home to a large number of business hubs and residential zones, relatively similar to its neighbor Kakab. Residential towns and commercial activities concentrate only along the commune’s prime streets, thus making property prices along the streets higher than its less developed or undeveloped outskirts.

In the third quarter of 2016, average land price along Confederation de la Russie (Russian Boulevard in English) in Chaom Chau commune was US$1,520 p.sqm., with a price range from US$1,400 p.sqm. to US$1,800 p.sqm.

National Highway 4, the Kingdom’s arterial road interlinked with the capital’s main boulevard Confederation de la Russia, could be offered on the market at US$430 p.sqm on average. The base price started from US$140 p.sqm in the farther west parts of the commune and a peak of US$1,300 p.sqm. in the areas close to Chaom Chau Circle.

On Veng Sreng Boulevard, land market prices could range from US$600 p.sqm in a less developed zone to US$1,550 p.sqm. in a more commercial zone, with the average market price at US$850 p.sqm.

Kakab

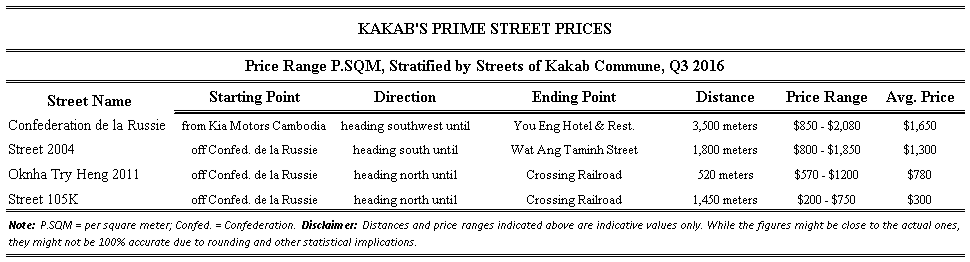

Kakab is closer to the city center, being home to Phnom Penh International Airport. The commune shares four of the capital’s main streets along which a large number of businesses are based, thus creating high values for land prices there.

One of the high value, prime streets in Kakab is Confederation de la Russie (Russian Boulevard in English), along which land price could be about US$1,650 p.sqm. in Q3 2016, ranging from US$850 p.sqm. often for a large portion of vacant land, to US$2,080 p.sqm. for a prime commercial location.

Another high value, prime street of Kakab is Street 2004, running off Confederation de la Russie through to Wat Ang Taminh Street. Along Street 2004, the average market price for land was US$1,300 p.sqm., with a range from US$800 to US$1,850 p.sqm.

Next, along Oknha Try Heng (Street 2011), which runs off Confederation de la Russie through to the crossing railroad, average land price was US$780 p.sqm., with a range from US$570 p.sqm. to US$1,200 p.sqm. On the other hand, Street 105K is less competitive in land prices. By the third quarter of 2016 the average market price along this street was US$300 p.sqm., even if in the sought-after locations the prices could jump to US$750 p.sqm.

Trend & Outlook:

Market & Pricing Trend

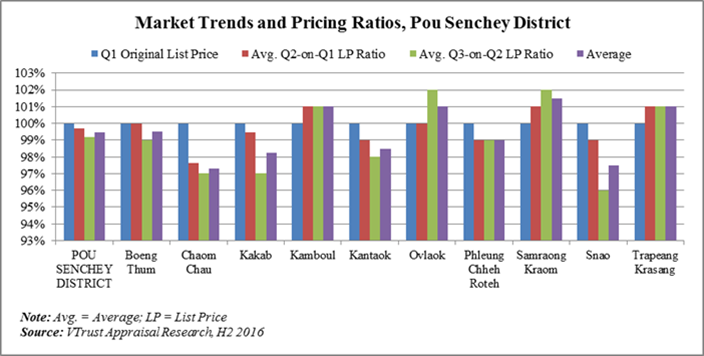

Land price growth across Pou Senchey district seemed stable since early last year, and it is predicted to see a slight increase over the course of the next two years by going through to 2018. In general, Pou Senchey’s pricing growth dropped negatively to 0.2 percent over the course of the first three quarters of 2016, though this has almost no impact on general price growth within the whole district.

However, land prices as well as other properties in the form of land in Phnom Penh will start to pick up markly again by 2019.

Urban Expansion

Thanks to its many available large portions of land for new developments and land properties with comparatively low prices, Pou Senchey has been seen with tremendous opportunities for urban expansion and relocation or new positioning of complementary services and amenities.

Residential towns, several other types of cluster housing, and commercial establishments have been positioned in many different parts of the district, especially the district’s outstanding communes of Kakab and Chaom Chau, resulting in an increase of population there and leading to increasing demand for new housing units and related infrastructure improvements.

Opportunities have been there since many years ago for Pou Senchey mainly thanks to its strategic locations, coverage of capital’s arterial roads and main streets, and large space available for urban expansion to host the increasing number of population as well as industrial and commercial positioning. Further, the increasing demand for development parcels with comparatively low prices also offer the district lots of opportunities for growth.

Since recent years, it is notable that a number of developments have concentrated in the commune of Kakab and Chaom Chau, both of which shares arterial roads and main streets, along which commercial activities exist to complement the increasing number of residential communities nearby the areas.

Tomnub Kop Srov Road, one of the capital’s ring roads, will be soon complete, while Veng Sreng Boulevard was rehabilitated by being expanded 22 meters wide and paved with concrete. Both of the roads run through parts of Chaom Chau and other parts of Phnom Penh. These establishments have created numerous opportunities, added further property values, and drawn new development potentials to the areas, especially along those streets.

In Kakab, recent developments are in the realm of residential and commercial subsector. Notable developments under construction are Budaiju Residence (condominium project) and Lion Mall (commercial and shopping complex) along Confederation de la Russie, as well as many other cluster housing projects, both complete and under construction. Up to date, in Kakab commune alone, about 2,700 new cluster housing units have been complete, and 950 are under construction. Nevertheless, 3,300 units of the planned housing projects have been halted construction so far due to unsatisfactory pre-sale results.

Industrial Trend:

Increasing land prices and rental costs in the zones nearby inner city center will force existing factories that rely on rents to consider relocating to the suburbs such as western parts of Pou Senchey where rental costs and cost of living of workers are much lower. Easy access to National Highway 4, which directs to the Kingdom’s most important seaport, might also weigh the consideration for new factory and other industrial park positioning.

As of today, Pou Senchey is already home to 40 percent of the total factories in Phnom Penh, ahead of Dangkao (22 percent) and Meanchey (15 percent).

Learn more about Cambodia today in our detailed location profile!

Comments