![]()

Cambodia as an emerging market has placed great importance into building quality infrastructure. This is evidence by the many existing friendship bridges and road projects that are currently underway.

This is a key consideration for investors, according to Marc Townsend – Managing Director of CBRE Cambodia and Vietnam – as stated in his recent presentation on the topic “Is Cambodia’s Residential Market a Target For Investment?”

Shifting from Agriculture:

Slowly but surely Cambodia has dug a little deeper into infrastructural improvements in recent years, compared to a policy that primarily focused on agricultural development in the past.

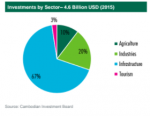

Around 67 percent of the $4.6 billion investments in 2015 came from the infrastructure sector. According to Townsend, infrastructure goes beyond what we normally think about infrastructure. He says, “It’s not just being able to get from A to B quicker, being able to move around faster, get goods and services quicker, logistics quicker. But it’s also the trickle down effect of those salaries that are being paid – not particularly big salaries being paid to construction workers but also to the entrepreneurs and the contractors and the subcontractors and all the people that are buying the cement and other products that go into the infrastructure.”

He explains that even with the great success of past infrastructure projects, “Cambodia needs probably ten years of infrastructure being the most important sector.” He adds, “Obviously, the road from here to Kep doesn’t get any safer, doesn’t get any wider, doesn’t get any better lit.”

Foreign Direct Investment:

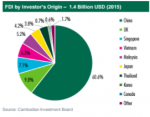

Townsend mentions that “it’s important to see where we’ve come from, where the FDI numbers have come from, and where they’re going to.” Cambodia’s FDI comes from countries like Canada, Korea, Thailand, Vietnam, Japan, Malaysia, Singapore, and the UK. But probably the biggest FDI contributions trace back to China. Their investments in 2015 totaled 60.6 percent out of the $1.4 billion that were placed in the country.

Townsend mentions that China’s contributions had been so great that “it’s almost impossible to find an article that talks about Cambodia without at least three paragraphs on China.”

Around $2 billion worth of infrastructure was also funded through China’s concessional loans. This includes the Four-Lane Express Way between Phnom Penh and Sihanoukville, the National Highway 11 which connects Preyveng to Kampong Cham, a bridge crossing the Mekong River from Steung Trang to Kruoch Chmar in Kampong Cham.

Other upcoming infrastructure projects will include the Sak Sampov Bridge, National Road 21a, National Road 58, Koh Thom Bridge, National Road 55, and the Chrey Thom Bridge. These projects are due to be completed anywhere between the next three years.

Smooth Landing:

Townsend also explains that more infrastructure means that “it will open up more land. You have had, in the last three to five years, a huge run up in land prices both in the CBD and around the CBD. But obviously, as ring road structures and bridges go in around the city, additional land becomes available. And hopefully, there’s an ability for price per square meter to stay stable for longer.”

The role of infrastructure is taking its root in the Cambodian market. Townsend says that it has both its good and its bad effects. Cambodia has the ability to prosper if it takes the right strategy in utilizing these investments and infrastructures to its advantage.

Find out more about development news in Cambodia on Realestate.com.kh!

Comments