If you are considering investing in the Cambodian real estate market or are even intrigued by how payments work for renting a property in the Kingdom, we will try and help you explain the basics and what to do to make transactions easier.

It should be said upfront that it can be challenging for foreigners to apply for a mortgage or home loan with banks in Cambodia, so as a buyer, it is important to choose the easiest payment methods to complete your property investment plan and consider the fees involved with overseas transactions

Cambodia is the most preferred destination especially for USD holders as a majority of property transactions are completed in USD. There are a few benefits in this being.

Investing Or Buying Property in Cambodia

There is a detailed breakdown of making payments for purchasing a property in Cambodia. Common payment methods for buying property include:

- Monthly installment payments - Monthly installment payments allow for regular payments over a set period of time, instead of paying the full price upfront - this makes it more manageable for consumers.

- Payments based on construction progress - This financing method (which is fairly common in the construction industry) entails dividing the total cost of the project into several installments, which are paid based on the completion of specific stages of the construction process. The payment schedule is typically outlined in the construction contract (which should be thoroughly checked and read). Milestones and percentages of the total cost are assigned to each installment.

- Full payments - Reasonably self-explanatory but the full amount is paid for a property usually within 30 days of signing the sales agreement. This is the preferred payment method for buyers and investors seeking the best investment price.

- Bank financing - This is the financing provided by a traditional lending institution such as a bank or credit union via a mortgage or loan but is mostly for Cambodian citizens.

An increasing number of banks have been offering loan services to the real estate industry, and some banks do provide loan support to international investors outside of Cambodia. Some long-term foreigner residing in the Kingdom who can show proof of income and their work history in Cambodia might be eligible to obtain a home loan from a bank

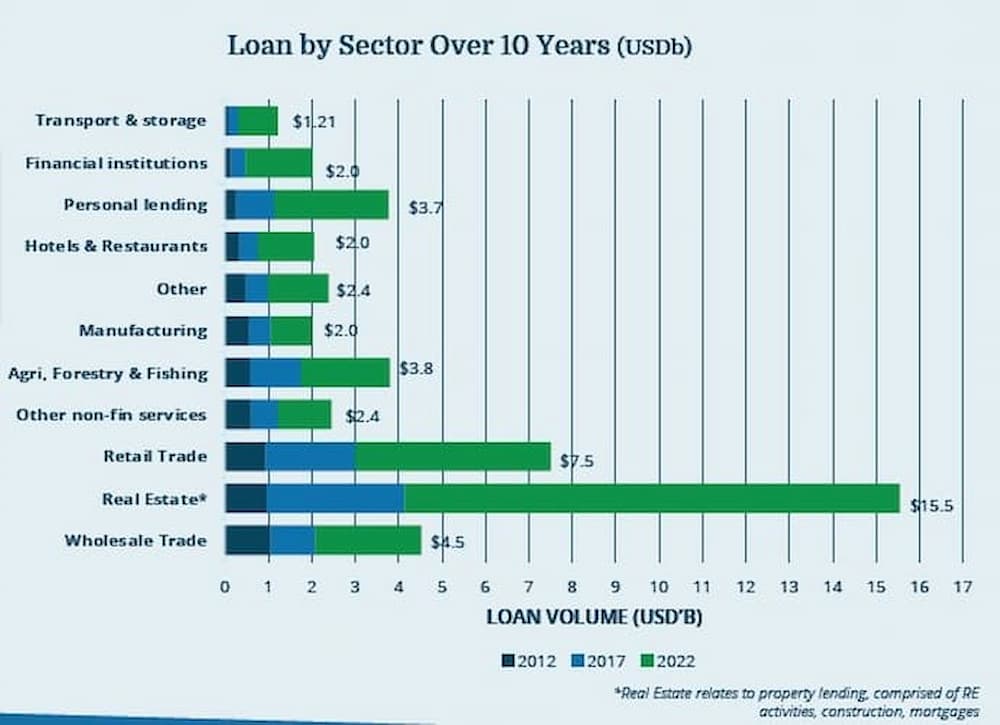

A recent report from Mekong Strategic Capital suggests that Cambodian real estate-related loans make up a third of total loans and have dominated growth over the past decade.

It is recommended that buyers and investors inquire with the developer during property viewing if they have partnered with any banks to provide loan services to foreign buyers.

Realestate.com.kh also offers a loan calculator to estimate how much you will need to pay per month if you choose to buy a property through a loan.

How Does Rental Payment And Deposit Work In Cambodia?

In terms of renting in Cambodia, there isn't a strict regulatory framework in place, but common practices among Cambodian landlords are to include all details for the renter in a rental contract which includes all details concerning the security deposit, obligations, utilities fees and other fine print which could include the early breaking of the contract etc

A security deposit serves as a safeguard for landlords against potential damages or breaches of contract and is a common aspect of renting in Cambodia. The exact amount of the security deposit can vary and often depends on the landlord's discretion but 1-2 months would be seen as normal for 1-2 year rental agreements - the longer term rentals often can mean a negotiated price lower than the regular asking price.

Some landlords, in cases of contracts spanning several years, might require a higher security deposit, ranging from 5 to 6 months' rent but this is rare - landlords would often be happy to have a long-term reliable tenant who pays on time.

- Tenants are usually required to pay rent in advance for each month of their tenancy and on a regular date. Tenants should be aware of this schedule to ensure timely payments and a good landlord-tenant relationship for a healthy relationship.

- It should be clarified how the utilities will be paid - utility fees such as water, electricity, and sometimes garbage collection are often paid separately (and quite easily in 2023 as many banking apps make it very convenient to do so). Some landlords might include utility fees in the rental payment to simplify the payment process for tenants

- Rental fees might not encompass all amenities such as for Wi-Fi, cable TV, and parking, could be separate from the base rent.

It should be clarified upfront what would happen if, as a tenant, you decide to terminate the contract early. A landlord may retain the deposit or need a one-month notice period - often the final month’s rent can be used in lieu of that month's rental fee.

Remittance and International Transfers To Cambodia

Transferring money to Cambodia is a relatively straightforward process, but it is important to have the correct documentation and comply with relevant laws.

Under the Law on the Foreign Exchange of September 1997, there are no restrictions on foreign exchange operations through authorised intermediaries, including purchases and sales of foreign exchange on the foreign exchange market, transfers, all kinds of international settlements, and capital flows in foreign or domestic currency between Cambodia and the rest of the world or between residents and non-residents.

Before transferring any amount of funds to Cambodia, it is important to check with your own bank in Cambodia to ensure that the correct documentation is completed and compliant with relevant laws.

Although international money transfers are not complicated, they are still seen as relatively in Cambodia but progress has been made:

- Cambodia was removed from the grey list - a list of nations under the Financial Action Task Force (FATF) - in 2023 and this should open up the ease of transfers globally.

- There is an increasing number of banks that have signed MoUs with global payment partners to allow for easier, faster, and more affordable remittance payments.

- Crypto payments are still not accepted but the government has been working with Binance to better understand the framework for cryptocurrency payments.

- Remittance transfers from Cambodians were worth approximately $2,63 billion in 2021.

The value of the transfers was estimated to reach a projected $2,720 million by the end of 2022.

It’s always best to check with both your local bank and the developer to see what your options are for payments and the fine details and an honest conversation with your landlord to make sure you know what you are entering into with regards to payments for rentals. Always ensure you have checked for additional or hidden fees that may be involved with transfers, and many services may run zero per cent fees on occasion.

Comments